Tax controversy: the changing landscape

Tax authorities are stepping up their efforts on a global scale and in Belgium, with an increased focus on precedent-setting cases. Taking controversies through to litigation is increasingly happening. With cross-border information sharing and access to big data and the latest technologies, they’re more effective than ever before. penalties for non-compliance are on the rise.

In the face of constantly changing regulations, organisations are struggling to stay on top of the changes and remain compliant. The uncertainty is fuel for tax controversies, Corporate tax controversies can lead to interrogations, media attention and financial and reputational damage. Organisations need to minimise risk by being prepared and narrow down the uncertainty and double taxation that is looming on the horizon.

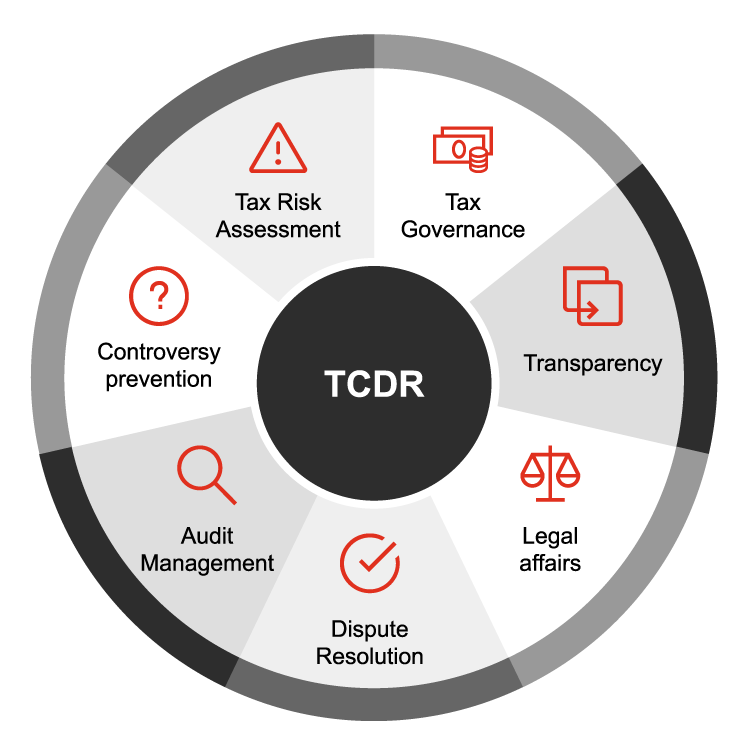

The six essential elements of tax controversy management and dispute resolution preparedness

In case of a tax controversy PwC can help reduce uncertainty, help manage tax audits and seek resolution in case of a dispute.

Our tax controversy and litigation experts will work with you to prepare for and minimise the risk of a tax controversy by focusing on the six essential elements you find on the wheel.

PwC: your ideal partner and trusted advisor

Our deep expertise, proven track record, global network and relationships with the tax authorities are what differentiates PwC. Find out more about what sets us apart.

- Solution-driven

- Multidisciplinary

- Cross-border

- Tax authority relationships

- Safeguarding taxpayer rights

- Enhanced litigation

Solution-driven

We aim to find solutions in your interest as early as possible in the dispute lifecycle and to mitigate the lengthy escalation of a dispute. Prevention is better than cure.

Multidisciplinary

We look into transactions and potential issues from different tax angles. We leverage our insights from other audits with technology-enabled risk screenings to be prepared. We can involve our PwC forensics and data analytics specialists to analyse big data to support your case.

Cross-border

In an era of increased foreign tax authority collaboration, we have a proven track record in managing multilateral audits and international exchange of information. We can call on our global network of specialists in all major countries.

Tax authority relationships

Even though we may fundamentally disagree on a position taken, we maintain captive working relationships with all bodies of the tax administration (field inspectors, central services, competent authorities, etc.) in view of efficient dispute prevention and resolution.

Safeguarding taxpayer rights

There are limits to the powers of investigation of the tax authorities. We look at procedural aspects from the outset to balance constructive cooperation with your fundamental taxpayer (defense) rights.

Enhanced litigation

With an increasing number of cases being brought before national and EU courts, we have the capabilities and credentials to defend both the merits and legality of your case with the lawyers of PwC Legal. We leverage strategies and expertise cross-taxes.

PwC’s Tax Controversy Mobile Solution

Insights from more than 75 countries at your fingertips

It is designed for tax professionals needing to know more about the hot issues and tax audit challenges that companies face today as well as to give access to the latest insights from more than 75 countries in just a few clicks.

The most common tax audit topics per country

The tax audit process per country

Instant access to experts and PwC tax controversy contacts in all countries

Regular updates, articles and insights on latest developments

Download the free PwC Tax Controversy Solution to your mobile device to catch up on the latest news, even when offline!

PwC’s Crisis App

Expert crisis management at your fingertips

Not sure what to do when a crisis hits? With the Crisis App, you can connect immediately with PwC’s experienced incident responders - no call centre, no being put on hold - and you’re guaranteed cross-functional support as needed within 24 hours, on-site and/or remotely. Via the app, you're tapping into deep crisis management expertise in the field you need, from business continuity incidents to dawn raids, cyber incident response and legal assistance.

PwC’s Crisis App gives you the peace of mind that no matter what happens, the help you need is just a few taps away.

Contact us