Mobilise finance to integrate ESG in business decisions

Sustainability in financial services

Transition towards a more sustainable economy is essential, to comply with regulations, meet demand, and mitigate financial and non-financial risks. This transition will have substantial material impact on financial institutions and it’s essential to prepare as early as possible.

Sustainable finance is the mobilisation of finance to integrate environmental, social and governance (ESG) criteria into business or investment decisions, leading to sustainable activities and growth, and the transition to a climate-neutral economy.

This mobilisation can be seen as a 5-step process, from strategy to disclosure:

Driven by regulation, market demand and risk

For financial institutions, the need to address sustainable finance is driven by increased regulation, market demand and various risks.

Regulators and supervisory authorities have been establishing sustainability/ESG requirements and standards that financial institutions and functions have to comply with, culminating notably in the 2018 EU Action Plan.

Meanwhile, the market demand for sustainable financial products and services is increasing significantly, especially in private banking and asset and wealth management (AWM). Accordingly, more solutions with an ESG focus are being offered to private and institutional investors.

Customers are increasingly willing to pay more for sustainable solutions. If several competitors offer similar conditions, customers can be expected – for ethical reasons – to base their decisions on sustainability considerations.

- The demand for sustainable solutions can enable significant additional business development, to offer new products and services, to address new client segments or to create innovative business models.

As ESG investing continues to take hold, there are risks of greenwashing: the combination of growing investor demand with a fast-evolving market and increasing regulation can give rise to [intentional or unintentional] greenwashing, in the form of misrepresentation, mis-labelling or mis-selling.

Sustainable finance breaks climate change risks for financial institutions into two categories:

Physical risks

The financial (socio-economic) impact of a changing climate, including more frequent extreme weather events and gradual changes in climate, as well as of environmental degradation

Transition risks

An institution’s financial loss that can result, directly or indirectly, from the process of adjustment towards a lower-carbon and more environmentally sustainable economy.

Integrating ESG into corporate strategy

Today, fulfilling ESG-related regulatory requirements, offering sustainable products and promoting ESG as an investment theme is a baseline for all financial services. But more is needed.

The increasing demand for sustainability in financial services makes it imperative to fully integrate sustainability and ESG into your mid- and long-term strategic ambitions.

Where you are on the ‘sustainability scale’ is fast becoming a key success factor. Not only as a response to market and investor demand and a creator of competitive advantage, but as an opportunity to generate new revenue sources.

New products and services: in response to market demand or to create new demand.

New client segments and target markets: either existing but not previously targeted, or for new products and services.

New business models: potential for innovation, e.g. new partnerships or distributions channels.

What can your organisation do?

In line with market and supervisory expectations, financial institutions will have to integrate ESG risks with their overall business model and strategy. This implies re-assessing your entire operating model.

- Strategy & Business Model

- Governance & Risk appetite

- Risk management, Stress testing & Scenario analysis

- Disclosure and Reporting

Strategy & Business Model

Financial institutions will have to identify, document, and determine the effects (from short to long term) of ESG risks by developing a set of new KPIs. These new risks can have a three-fold impact on the business environment in which you operate, namely through macroeconomic shocks, the competitive landscape, and market sentiment.

Macroeconomics shocks

Economic growth, unemployment rates, real estate prices at national, regional, or local level might experience a shock due to physical events (e.g. massive floods) and transition events (e.g. government implements policy that makes a certain area less attractive driving prices down or vice versa).

Competitive landscape

With increasing regulation and technological advancement, banks that are highly exposed to energy-intensive industries (e.g. oil sector) will probably see their clients needing significant capital expenditures to pursue decarbonization.

Market sentiment

Consumers might prefer greener banks and products to a cheaper non energy efficient financial institution.

Particularly, reputation considerations linked to sustainability is becoming more and more important to clients.

The extent to which these factors will impact your strategy and business model will be clarified through a scenario analysis and stress testing exercise, which will also help define new KPIs and KRIs and highlight the limitations, vulnerabilities, and shortcomings of current available data.

Governance & Risk appetite

The management body is expected to specifically address ESG risks when developing the strategy, objectives, and risk appetite framework. This implies that your whole organisational structure and reporting framework has to be revised on the basis of these new risks.

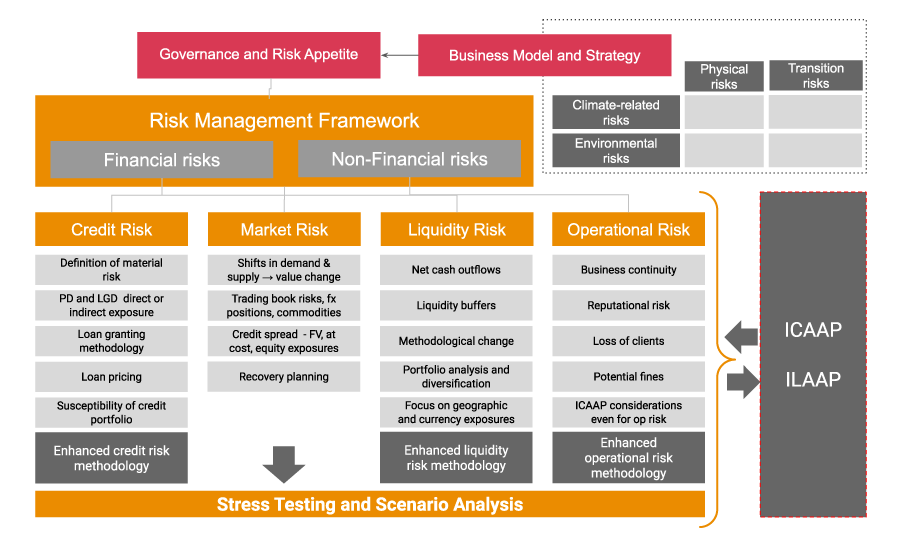

Risk management, Stress testing & Scenario analysis

Financial institutions will have to fully integrate climate-related and environmental risks with their risk management framework. From credit to operational risk, a newly integrated framework will be shaped by capital considerations and will in turn affect those requirements.

Conducting climate risk materiality assessment enables you to identify the main exposures each portfolio is exposed to, considering geographies, sectors and related transmission channels

Not only are climate scenario analyses and stress testing the next logical steps, but they are required under ECB expectations. In the supervisory stress test, scenarios are modelled based on the timelines and depth of policy action. Climate change evolves differently under each scenario, so companies are affected differently. From challenges such as lack of data to scenario modelling, we can support you throughout the entire process.

Disclosure and Reporting

Financial institutions will have to disclose information about their consideration of, and approach to, ESG risks, including the materiality level of each of the identified risks, underlying methodologies, KPIs and KRIs.

In addition, the Corporate Sustainability Reporting Directive (CSRD) is driving a significant number of efforts to collect and assess data that are relevant and material to report, based on the applicable EU sustainability reporting standards (ESRS).

Under SFDR, financial institutions will also have to comply with multiple other disclosure obligations (e.g. principal adverse impacts on sustainability factors, pre-contractual information for products promoting environmental or social characteristics or having a sustainable investment as objective etc.).

How PwC can support your sustainable finance initiatives

We take a holistic approach to ESG financial services, from impact assessment and analysis, to reporting, to ongoing monitoring. Our core services are:

- Materiality assessments

- Disclosure

- ESG and sustainable finance upskilling

- Climate risk stress testing

- Reporting and assurance

- Dashboarding

- Transformation path

- Technology

Materiality assessments

Assessing the impacts of climate-related and environmental physical and transition risks on all asset classes of the balance sheet; guiding you in the materiality assessment methodology for non-financial reporting purposes (e.g. CSRD)

Disclosure

Conducting alignment assessments of the investment portfolio against the EU taxonomy and SFDR; carrying out SFDR compliance gap analyses and preparation of related remediation action plans; supporting with the drafting of disclosures (pre-contractual information, PAI statement, website etc.).

ESG and sustainable finance upskilling

Training for boards of directors, management committees, operational teams, etc.

Climate risk stress testing

Integrating climate change scenarios into internal stress tests, focusing on the methodology as well as the scenarios to use; performing sectoral studies.

Reporting and assurance

Preparation and assessment of external ESG reportings aligned with CSRD and related EU Taxonomy, based on the analysis of the relevant applicable EU sustainability reporting standards (ESRS) and in-depth materiality assessment.

Dashboarding

Support to develop an ESG Risk dashboard (KRI) to follow up on ESG risks internally.

Transformation path

Helping you build the path towards the alignment of all function in achieving your ESG ambition, through the building and execution of the key milestones of a strategic roadmap integrating data management processes, technology and regulatory obligations.

Technology

Advising on the technology means and implementation activities that will best support your data and reporting processes.

We also offer a number of tools and methodologies, including the PwC Climate Excellence Tool, a software to make climate-related financial impacts visible.

Contact us

Partner Sustainability, Risk & Compliance, PwC Belgium

Tel: +32 476 47 19 59