{{item.title}}

{{item.text}}

{{item.text}}

Fueling our future

Green hydrogen has potential to be a primary source of clean energy

Hydrogen (H2), the most abundant element in the Universe, has the potential to be the key to climate neutrality and the decarbonisation of energy and heat production.

Depending on perspective, hydrogen may be seen as the solution to the net zero transition or as a disappointing, expensive technology that is not viable at scale. Or anything in between. That’s because there are so many ways to produce and store hydrogen that its long term viability – or its green credentials – are not easy to pinpoint.

When burned as a fuel, hydrogen emits only water. But creating H2 can be carbon intensive. To simplify the discourse, hydrogen is generally classified in an intricate colour system, ranging from black to green, that defines its production method (using electricity from fossil fuels, nuclear, biomass, solar, wind, etc.). ‘Grey’ hydrogen – which accounts for 99% of current hydrogen production – is produced through the oxidation of fossil fuels, with CO2 as a by-product. Adding carbon capture and storage (CSS) to the process delivers ‘blue’ hydrogen, but also adds to the cost. To date, the term ‘green’ hydrogen has been used to describe hydrogen produced using electricity from renewable sources. It represents only around 1% of hydrogen production.

There are very real prospects of increasing the production of green hydrogen, thanks to cheaper renewable energy, for example from utility-scale solar electricity from North Africa and the Middle East, or from massive offshore wind farms. The International Renewable Energy Agency has forecast that “future costs of green hydrogen will be below those for blue hydrogen”.

Today, there are initiatives around the world to take the next step, producing hydrogen without electricity in greener-than-‘green’ or ‘ultra-green’ systems, such as photosynthesis-based processes using light instead of electricity, or net negative CO2 removal. These innovations, however, are currently at experimental, lab-scale or very early-stage production, and still far from large-scale implementation.

It’s clear that it’s not a simple matter of ‘switching’ to hydrogen. But under the pressure to achieve decarbonisation, green hydrogen stands as one of the best alternatives we have in the energy transition. That’s why EU and national authorities are directing resources to speed up green hydrogen development.

With countless initiatives underway, all aimed at scaling up hydrogen production and uptake, it is essential to prioritise investments in solutions that promise the greatest CO2 reductions and the least operational constraints, while in parallel paving the way for innovations that offer a paradigm shift and/or the best long term potential.

Clean hydrogen will have a central place in the climate-neutral economy of the future. … We have to scale up clean hydrogen production, expand its applications, and create a virtuous circle where demand and supply feed each other and bring the prices down.

Ursula von der Leyen President, European Commission, European Hydrogen Week 2021To support hydrogen uptake in the EU, the EU Hydrogen Strategy was adopted in 2020. Its purpose is to scale up development of the infrastructure and support hydrogen investments, with the ambition to produce 12.8 million tonnes and import 12.8 million tonnes of renewable hydrogen by 2030. The main focus of the strategy is to accelerate the uptake in energy-intensive industrial processes, which today generate the most CO2.

The strategy includes 20 key actions: concrete measures that support the creation of a European competitive hydrogen economy, able to face growing international competition.

The actions cross many different EU missions and initiatives. Some of these are highlighted below.

In Belgium, the government has rolled out a federal hydrogen strategy. It is based on a forecast that the country will remain dependent on overall energy imports to cover its domestic demand, including an estimated 2–6 TWh of renewable hydrogen (or derivatives) in 2030 and 100–165 TWh in 2050.

The strategy focuses particularly on decarbonising energy-intensive industries as well as heavy and maritime transport, while positioning Belgium as a key player in the hydrogen market. It is built on four pillars:

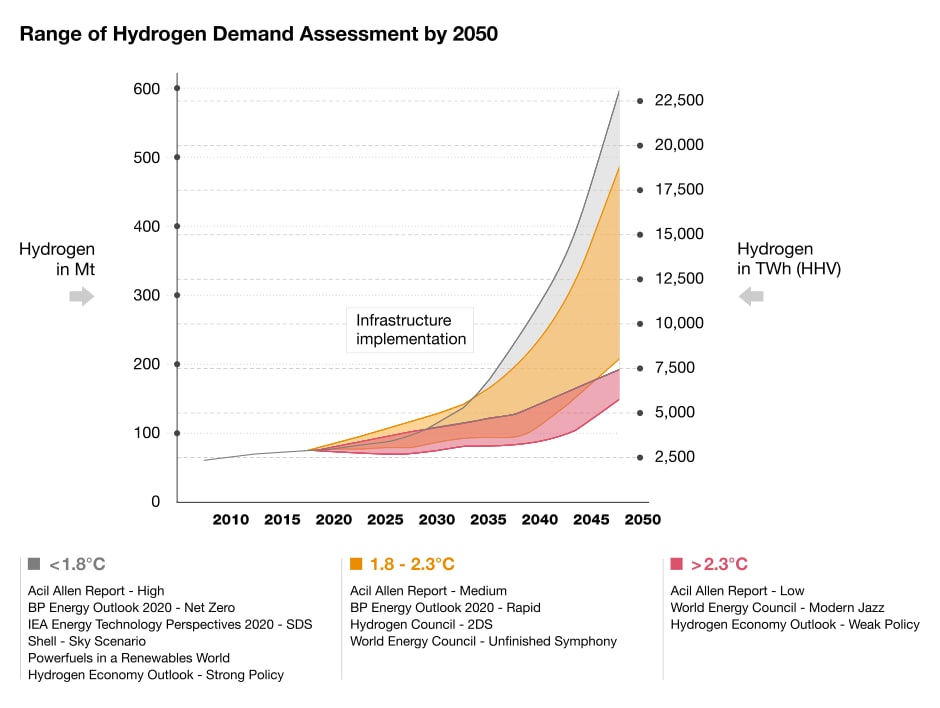

There is no doubt that in the next ten years, global demand for hydrogen will increase, largely driven by the necessities of decarbonisation. Niche applications and a small number of pioneering companies will emerge, possibly with revolutionary outcomes. Local projects and technical research will reveal insights into how to cut costs.

Strong market growth is then expected from 2030 onwards, as the realised cost reductions and infrastructure measures make hydrogen a competitive and available alternative.

Hydrogen has the potential to make an important contribution to climate protection by decarbonising entire industries. To truly make a difference in reaching climate neutrality, the focus must be on green hydrogen. However, blue hydrogen may need to be part of the initial transition, given the limited amounts of green hydrogen available in the short term.

In view of the public communication about hydrogen – ranging from hype to disillusion – and in parallel with the pressure to meet decarbonisation targets, it’s understandable that many businesses are unsure about where they stand. Taking the next step can start with basic questions.

How energy-intensive is our business? To what extent does decarbonisation impact our survival?

Where are we in the decarbonisation compliance schedule?

How well positioned are we to start transforming our processes to transition to green (or blue) hydrogen?

What areas of our business could achieve the most CO2 reduction or other benefits? Transportation? Industrial processes? Building heating and power? Other?

What is the projected supply/demand? Can we be sure our needs are met?

How can we develop a company-specific hydrogen strategy (technology, M&A, partnerships, etc.)?

What are the marketing/branding, legal, regulatory, certification and reporting implications?

How might we achieve the optimal balance between efficiency and green energy/hydrogen?

How could we pilot this technology? How could we roll it out?

How can we purchase hydrogen and participate/benefit from this value chain?

How could we finance projects/transition? What funding/subsidies are available?

How can we forecast and budget in a fast-evolving hydrogen market?

How can we ensure that our energy imports don’t fall under the CBAM (Carbon Border Adjustment Mechanism)?

How can we leverage hydrogen to showcase our eligibility/alignment with the EU taxonomy?

How can we connect our hydrogen strategy with our non-financial reporting activities?

Developing a hydrogen strategy specific to your company and markets

Identifying pilot projects, including scope, technical requirements, funding, etc.

Building a business case including technical and financial feasibility analyses (e.g. impact on operations, use of by-products, available incentives, subsidies and funding, etc.

Identifying your requirements related to technology, R&D, M&A activities and partnerships

Creating procurement and trading strategies

Understanding and assessing national and international legal and regulatory implications, such as certification models for green hydrogen and its derivatives, etc.

Integrating relevant projects into reporting.

PwC assists businesses in assessing their position regarding decarbonisation and hydrogen adoption strategies, and in deciding on a strategy and implementation roadmap.

We share with our clients comprehensive insights into the market and technology, and relevant business cases and related legal aspects. In short, we can help you build a more sustainable business, by bringing you our expertise in ESG, tax, regulatory and reporting issues, financial modelling, technology, deals and procurement, and much more.

PwC will support you from strategy through execution in your energy transition journey

Creating your hydrogen strategy, identifying value pools and developing roadmaps to help you build a transition strategy.

Understanding the impacts of hydrogen on your current market, and assessing the tax and legal regulatory environment, and the supply and demand situation

Undertaking feasibility studies, and techno-economic, risk and business case analyses, to help you assess opportunities and specific projects.

Carrying out financial assessments, from understanding the funding incentives landscape to undertaking due diligence on hydrogen-related assets. Support in identifying target investments. Project support, including financial modelling, finance raising, deal structuring and procurement.

Support in aligning your non-financial reporting with your hydrogen initiatives.

{{item.text}}

{{item.text}}