Stay up to date with tax reform in Belgium

Entities - Companies

Latest update: 31 July 2018

On 24 July 2018 the federal government reached a social and labor “summer agreement” (so-called jobsdeal) containing some tax measures, such as changes to employer’s tax reporting obligations of some equity incentives and the acceleration of the entry into force of the 30% EBITDA rule from 2020 to 2019.

At the end of 2017, the Corporate Income Tax Reform Act and the Program Act have introduced an important tax reform package. As key components of this package, the corporate income tax rate is being gradually reduced to 25% in 2020, and fiscal consolidation will be introduced. The reform takes effect over a three-year period (2018, 2019 and 2020).

On 1 March 2018, the Constitutional Court annulled the fairness tax going forward, specifically stating that the tax would be maintained for assessment years 2014 up to and including 2018. The Court ruled that, for instance, where dividends were redistributed in a manner falling within the scope of the Parent Subsidiary Directive, the fairness tax would be annulled retroactively.

Subsequently, on 19 July 2018 the Chamber passed a draft law amending and supplementing the Corporate Income Tax Reform Act and the Program Act (“Act on Various Income Tax Provisions”, hereinafter referred to as “the amending law”). The most important changes and technical improvements introduced by the amending law are included in the text below.

Corporate Income Tax Reform Act of 25 December 2017 (Official Gazette of 29 December 2017)

Corporate income tax rate

The standard corporate income tax rate of 33% is lowered to 29% in 2018 and to 25% as from 2020. Small and medium-sized enterprises (SMEs) will see a decrease in the rate to 20% as from 2018 for the first bracket of EUR 100,000 in profit. These rates are to be increased with the crisis tax, which is also lowered for 2018 and will be abolished in 2020.

2018 |

2020 |

|

Old corporate income tax rate |

33% |

33% |

New corporate income tax rate |

29% |

25% |

SMEs (first bracket of EUR 100.000) |

20% |

20% |

Former crisis tax |

3% |

3% |

New crisis tax |

2% |

0% |

Measures for 2018

- The 95% dividends-received deduction (DRD) is increased to 100%, resulting in a full participation exemption.

- The separate 0.412% capital gains tax for multinational enterprises on qualifying shares is abolished, while the conditions to benefit from the capital gains exemption are brought in line with the DRD. This implies the application of a minimum participation threshold of at least 10% or an acquisition value of at least EUR 2.5 million in the capital of the distributing company.

- Capital gains on shares whose dividends partly entitle to the DRD regime are also partially exempted (DRD-SICAVs/BEVEKs, SIRs/GVVs etc.). Specific rules apply to capital gains after a restructuring.

- In a nutshell, in 2018 and 2019, capital gains on shares are:

- exempted provided that all the conditions are met;

- taxed at 25.5% if the one-year holding period requirement is not met;

- taxed at 29.58% if the participation condition or taxation condition is not met.

- As from 2020, capital gains on shares are:

- taxed at the standard rate (25%) if one condition is not met.

- also exempted when all the conditions are met

- The wage withholding tax exemption for scientific research personnel is extended to include holders of a bachelor’s degree. The exemption is applicable for up to 40% of this wage withholding tax as from 1 January 2018, and for up to 80% as from 1 January 2020.

- The notional interest deduction (NID) is maintained, but, as from 2018, it is calculated based on the incremental equity (over a period of five years) and no longer on the total amount of the company’s qualifying equity. Simplified, the incremental equity equals one-fifth of the positive difference between the equity as at the beginning of the taxable period and that as at the beginning of the fifth preceding taxable period. The current rules on equity formation and exclusions as well as on stock of carry-forward NID remain applicable. The rate is the rate of the financial year to which the tax return relates. An anti-abuse measure is introduced by the amending law to tackle the contribution in capital made by an affiliated company by means of borrowed funds. Two other specific anti-abuse provisions are added in order to exclude from the calculation base the receivables from and the capital contributions by a non-resident taxpayer or a PE situated in a country that does not exchange information with Belgium, except if the company can prove that the concerned operations meet lawful financial or economic needs. Finally, the amending law provides for the application of the continuity principle in case of contribution of one or more branches of activity or universality of goods (as it is in case of mergers, demergers, etc.).

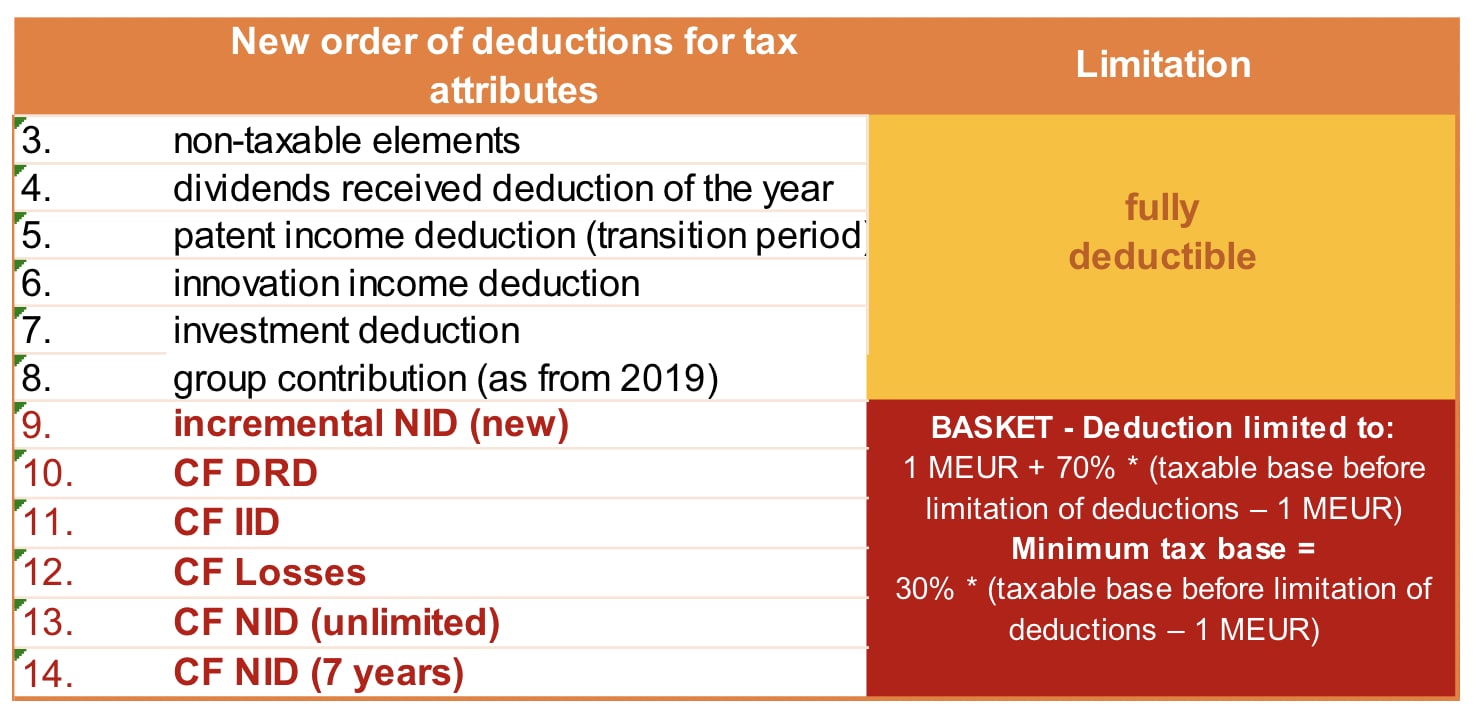

- To finance these new measures, a minimum tax charge is imposed on companies making profits of more than one million euros by limiting the number of corporate tax deduction items (“tax attributes”). Also a new order of deduction applies (see below). As from 2018, deduction items outside the basket are fully deductible. Deduction items within the basket can only be claimed on 70% of profits exceeding the one-million threshold. The remaining 30% of profits are fully taxable at the above new rate. The tax attributes concerned are the deduction of carry-forward tax losses (CF losses), carry-forward dividends-received deduction (CF DRD), carry-forward innovation income deduction (CF IID) and carry-forward notional interest deduction (CF NID) as well as the new incremental NID. Deduction for investments (whether general or innovation related) is excluded.

The new rules do not apply to losses incurred by SMEs starters.

- The current limited deduction of prior-year losses in the framework of a tax-neutral reorganisation also applies to the CF DRD. The amending law provides that this provision is applicable to operations executed as from 1 January 2018.

- Minimum company director fee: SMEs can benefit from the reduced corporate income tax rate on the first bracket of EUR 100,000 if certain conditions are met. In this regard, the company must grant to at least one company director (natural person) a fee of minimum EUR 45,000 (instead of EUR 36,000) or possibly lower, depending on the taxable income. Exceptions are available for SME start-ups.

In order to prevent any abuse, a distinct taxation of 5% (as from 2018) is due by each company (large or small) that does not grant the minimum fee. The amending law specifies that the director receiving the minimum fee has to be a natural person. The tax is due on the difference between the highest compensation actually paid and the required amount, and is deductible. For affiliated companies of which at least half of the directors are the same people, the total amount of the minimum director fee has to be EUR 75,000. Exceptions are also provided for SME start-ups.

The above measure is applicable for corporate income tax purposes. The amending law, however, extends its application to non-resident income tax/companies.

Moreover, the distinct taxation will be increased in the case of no or insufficient tax prepayments (amending law).

- SMEs benefit from an increase in the investment deduction from 8% to 20% for the next 2 years (assessment years 2019 and 2020) for asset acquired or created between 1 January 2018 and 31 December 2019.

- Reimbursements of paid-up capital: the reimbursement of capital is deemed to derive proportionally from paid-up capital and from taxed reserves (incorporated and non-incorporated into capital) and exempted reserves incorporated into capital. The reduction of capital will be allocated to paid-up capital in the proportion of the paid-up capital in the total capital increased with certain reserves. The portion allocated to reserves is deemed to be a dividend and becomes subject to withholding tax (if applicable). Share premium distributions are submitted to the same system. Exempted reserves not incorporated into capital continue to be outside the scope of the rule. Some elements, such as (but not limited to) revaluation surpluses, provisions for liabilities and charges, and unavailable reserves, have to be withdrawn from the reserves taken into account for the coefficient calculation. A sequence of allocation has been set for situations where the amount of the paid-up capital and sums being treated as capital are insufficient. This change is applicable to capital reductions decided by general meetings held on or after 1 January 2018

- Pre-paid costs have to be deducted in the year of payment in the proportion of the part of the charge that relates to this accounting year (application of the accounting matching principle). It is then no longer possible to shift costs that will only be made in the future to the current year in order to reduce the tax charge on the current-year profits

- Provisions for risks and charges are only deductible for tax purposes if:

- they correspond to an existing and known obligation at year-end closing (in addition to the other conditions already existing)

- they result from any contractual, legal or regulatory obligation (other than those resulting merely from the application of the law on accounting rules and annual accounts). This change does not apply to existing provisions created before assessment year 2019.

- Other measures to apply as from 2018 include (without being limited to) the removal of the investment reserve system and a change to the capital gains tax for which spread taxation was requested but for which the re-investment did not take place within the legal deadline or in compliance with the legal conditions: such capital gains will be taxed at the nominal rate applicable in the year in which the capital gain is realised.

- Further to the 100% DRD, the special Tate & Lyle withholding tax rate is replaced by a withholding tax exemption.

Compliance related measures (as from 2018)

- Tax supplements resulting from a tax audit will effectively become due, without the possibility to offset these supplements against, for instance, current-year losses. It will, however, remain possible to claim the DRD of the current financial year. Such tax supplements will constitute a minimum tax base. This measure only applies if tax penalties equal to or higher than 10% are effectively applied. In other words, questions of principle would normally be outside the scope of this new rule.

- Companies will be encouraged to make more tax prepayments. The basic interest rate increases to 3% (instead of 1%). The increase will always be applied as from 2018. The rate of the tax increase with regard to advance payments will be 6.75% in assessment year 2019.

- In the absence of a corporate tax return, the minimum taxable lump sum amounts to EUR 34,000 from 2018, and to 40,000 from 2020 (instead of currently EUR 19,000). It will be indexed on an annual basis. In the event of repeated infringements, the minimum taxable lump sum increases from 25% to 200% (from the fifth infringement). The taxpayer may always produce evidence to the contrary.

- The default interest and late payment interest system has been reviewed. Late payment interest amounts to minimum 4% (and maximum 10%). The default interest rate is 2% lower than the late payment interest rate. These rates are linked to the OLO interest rate and will then be adapted on an annual basis according to the latter rate. The default interest rate is due as from the first day of the month following the month of the formal notice and provided that the taxpayer has actually paid the tax.

Measures for 2019

- For the first time in Belgian income tax history, tax consolidation will be introduced as from assessment year 2020, i.e. years starting 1 January 2019 or later. In practice, Belgian companies will be able to transfer taxable profits to other Belgian affiliated companies with the aim to offset these profits against current-year tax losses. This transfer has been coined “deduction of the group contribution”. In the end, the group companies will compensate each other for the tax burden of the group contribution, as a result of which the tax consolidation will be financially neutral.

The scope of the consolidation regime is limited to certain qualifying companies:

- a 90% direct shareholding between the companies (or via the EEA parent company) during the entire assessment year is required, limiting the scope to the parent, subsidiary and sister companies and their Belgian permanent establishments;

- the measure is limited to group companies that have been affiliated for at least the last five successive calendar years;

- some companies such as investment companies and regulated real estate companies (SIRs/GVVs) are excluded.

In order to benefit from this new system of tax consolidation, the group companies concerned have to conclude a “group contribution agreement” that meets the following conditions (that have to be effectively put in place):

- the agreement covers a specific assessment year;

- it has to mention the amount of the group contribution;

- the receiving resident company or permanent establishment (PE) commits to report the amount of the group contribution in its tax return (corporate income tax or non-resident income tax) as included in the profits of the assessment year (no deduction other than the current-year loss can be claimed against the amount of the group contribution; in this regard, the amending law provides that no deduction can be made on the part of the intragroup transfer that would exceed the current-year loss);

- The taxpayer commits to pay the receiving resident company or PE a compensation corresponding to the additional tax that would have been due if the group contribution had not been deducted from the profits of the assessment year;

- the agreement is filed together with the tax returns of the entities concerned (each entity is still required to file its individual tax return).

- a 90% direct shareholding between the companies (or via the EEA parent company) during the entire assessment year is required, limiting the scope to the parent, subsidiary and sister companies and their Belgian permanent establishments;

The group contribution is deductible from the taxpayer’s profits of the assessment year provided that the profit is effectively included in the tax return of the receiving company and provided that the compensation has actually been paid (proof should be provided if requested).

Under similar conditions it will in practice also be possible to deduct final losses of a foreign subsidiary under the consolidation regime. However, a recapture rule of the final losses is introduced when the activities are restarted within the period of three years in the foreign country.

The amending law provides for an anti-abuse measure in the case of reorganisation. According to this provision, a merged company can only qualify for the consolidation if all individual companies were qualifying companies before the merger.

- The Corporate Income Tax Reform Act implements the European Anti-Tax Avoidance Directives I and II (Council Directive EU 2016/1164 of 12 July 2016 and Council Directive EU 2017/952 of 29 May 2017). The implementation of the measures (i.e. CFCs, exit taxation, hybrid mismatches and the interest limitation rule) will take effect in 2019.

- Under the new CFC rules, certain non-distributed income of a CFC will become taxable in Belgium at the level of the Belgian controlling taxpayer. A CFC is a low-taxed foreign company (or foreign PE) of which a Belgian taxpayer (alone or together with its associated enterprises) holds directly or indirectly more than 50% of the voting rights or the capital or is entitled to receive more than 50% of the profits of that entity. In addition, the CFC either is not subject to income tax under the applicable rules of its residence State or is subject to income tax that is less than half of the corporate income tax of the CFC computed based on Belgian rules.

Based on the so-called transactional approach, non-distributed income of the CFC arising from (a series of) non-genuine arrangements put in place for the essential purpose of obtaining a tax advantage becomes taxable. This is the case to the extent that the CFC would not own the assets or would not have assumed the risks that generate all or part of its income if it had not been controlled by a company where the significant people functions that are relevant to those assets and risks are carried out and are instrumental in generating the CFC’s income. Income that is not generated by assets or risks linked to the significant people functions carried out by the controlling company is out of scope. Measures to avoid double taxation are provided via a 100% DRD for distributed income or, as it is introduced by the amending law, for non-exempt capital gains when the CFC is transferred provided that the income has already been subject to tax under the Belgian CFC rules.

The CFC rule will enter into force as from an assessment year 2020 that is linked to a taxable period that starts, at the earliest, on 1 January 2019.

The amending law introduces an obligation for the taxpayer to report the existence of a CFC whose profits are taxable in its hands. The same reporting obligation is extended to the existence of a permanent establishment whose profits are not attributed to this permanent establishment.

- The exit taxation rules are further completed by covering all transactions referred to in the ATAD I Directive (e.g. transfers of assets from head office to PE) and by imposing a step-up in the case of an inbound transfer from another Member State or from third countries provided that the gain has been subject to tax in the exit State and Belgium has concluded with the exit State a bilateral treaty or a bilateral or multilateral instrument that allows for an exchange of information.

The Act of 1 December 2016 already introduced the option to defer the exit taxation over 5 years and the possibility to request a guarantee (without interest) (see existing art. 413/1 of the Income Tax Code (ITC)).

The new exit taxation rules will enter into force on 1 January 2019 for transfers taking place on or after 1 January 2019.

- A series of rules and definitions is inserted in Belgian tax legislation to tackle hybrid mismatches, tax residency mismatches and imported mismatches in line with the ATAD II Directive.

These new hybrid measures will enter into force as from an assessment year 2020 that is linked to a taxable period that starts, at the earliest, on 1 January 2019.

- A new interest limitation rule is introduced on the basis of article 4 of the ATAD I Directive (“30% EBITDA rule”).

- This new rule must be computed at the level of each taxpayer (Belgian company or PE). Three types of taxpayers are out of scope: financial undertakings, standalone entities, and public private partnerships. According to the amending law, the list of financial undertakings out of scope includes leasing and factoring companies (the latter must be operating “within the financial sector”), as well as companies which main activity is the financing of real estate through the issuance of real estate certificates.

- The exceeding borrowing costs are computed on a net basis and they take into account payments economically equivalent to interest (exact guidance still to be communicated – based on the Directive). Three types of loans are outside the scope of the exceeding borrowing cost computation: loans granted before 17 June 2016 without “fundamental modification” (grandfathering rule – still subject to old 5:1 thin cap rule), loans in relation to public-private co-operation projects, and loans granted between Belgian entities that are part of the same group.

- The law offers a mechanical rule to compute the tax EBITDA, which starts from the result of the taxable period after the first operation.

- For each taxpayer, exceeding borrowing costs will be deductible up to the highest amount of 30% tax EBITDA or EUR 3 million (= de minimis/safe harbour rule – EUR 3 million to be allocated across Belgian group entities - exact guidance still to be communicated). Disallowed exceeding borrowing costs can be carried forward without time limit. Alternatively, the amending law provides for a transfer of “deduction capacity” to another Belgian group entity (while the current law provides for a transfer of exceeding borrowing costs). This must be analyzed in conjunction with the new consolidation regime. Disallowed exceeding borrowing costs are not part of the tax base as set in article 185bis, which means that the companies taxed on this basis (e.g. regulated investment companies or regulated real estate companies) are de facto out of scope.

- This new rule must be computed at the level of each taxpayer (Belgian company or PE). Three types of taxpayers are out of scope: financial undertakings, standalone entities, and public private partnerships. According to the amending law, the list of financial undertakings out of scope includes leasing and factoring companies (the latter must be operating “within the financial sector”), as well as companies which main activity is the financing of real estate through the issuance of real estate certificates.

Although this measure would only enter into force as from 2020, the Belgian government decided in July 2018 that it would advance the entry into force to 2019 (assessment year 2020 that is linked to a taxable period that starts, at the earliest, on 1 January 2019).

Measures for 2020

- Permanent establishments (PE):

- The PE definition in Belgian legislation has been modified in line with the OECD/BEPS guidelines containing a more economic PE concept. Although the domestic PE definition is mainly relevant for non-treaty situations, this modification will ensure that national legislation does not create an obstacle if and when the new PE concept is introduced in Belgium’s double tax treaties. The definition of Belgian PE includes commissionaires or similar companies that act in their own name but which are closely connected with a foreign company. The PE definition will be further adjusted in line with BEPS Action 1 (Digital economy) and related ongoing EU actions.

- The deduction of foreign PE losses by a Belgian head office will going forward only be granted for final PE losses from within the EEA. PE losses are final when the PE’s activities have been terminated and to the extent that these losses are not deducted from other income in the PE State (e.g. income from other entities or in the framework of a tax consolidation). The possibility of recapture is introduced for deducted final PE losses in the event that the Belgian company would restart activities in the PE State within three years after the PE’s closure.

- Discounts on long-term debts related to non-depreciable assets will no longer be deductible.

- Company cars: the tax reform also aims – once more – to strengthen the rules on the tax charge applied to company cars for Belgian companies. In general, under the current system, the deductibility rate of car costs for Belgian companies and Belgian PEs varies in a range of between 50% and 120% of the costs, depending on the type (fuel) and CO2 emission of the company car. The deduction for fuel costs is set at 75%.

These rules change as follows:

- The deductibility rate of car costs is linked to the actual CO2 emission level of the car and will range between 50% and 100% according to the following formula: 120% - (0.5% x coefficient x gr CO2/km). The coefficient is 1 for vehicles running on diesel, and is 0.95 for vehicles with a different engine. For highly-polluting cars, the deductibility will be limited to 40%. A highly-polluting car is a car with a CO2 emission of 200 grams or more.

- Under the current rules, car costs for so-called ‘fake’ hybrid cars (rechargeable hybrid cars) can easily be deductible at 90 or 100% because of the posted low CO2 emission level. According to the new rules, ‘fake’ hybrid cars are vehicles with a fuel engine and a rechargeable electric battery with an energy capacity lower than 0.5 kWh per 100 kg of vehicle weight, or with a CO2 emission level of more than 50 gr/km. Under the new rules, the deductibility and tax charge on the corresponding benefit in kind are aligned to the tax treatment of its non-hybrid counterpart. By lack of corresponding car, the CO2 emission value will be multiplied by 2.5. The current system continues to apply to hybrid cars acquired before 1 January 2018.

- The deduction for fuel costs is no longer fixed (at 75%) but will also be linked to the CO2 emission of the car.

- Costs in relation to electric cars are only deductible up to 100% instead of 120%.

- Exceptions to the limited deductibility will be available for taxi services, rental cars with drivers, driving schools and vehicles leased only to third parties. The limited deductibility is also inapplicable to taxpayers who re-invoice the car costs to a third party.

- The deductibility rate of car costs is linked to the actual CO2 emission level of the car and will range between 50% and 100% according to the following formula: 120% - (0.5% x coefficient x gr CO2/km). The coefficient is 1 for vehicles running on diesel, and is 0.95 for vehicles with a different engine. For highly-polluting cars, the deductibility will be limited to 40%. A highly-polluting car is a car with a CO2 emission of 200 grams or more.

- Limited deduction of other business expenses such as fines and taxes: all administrative fines imposed by a public authority become disallowed expenses even if they do not qualify as a criminal penalty or if they are related to deductible taxes. Increases related to social security contributions also become disallowed expenses. The distinct tax charge on secret commissions is no longer deductible. Hidden profits are no longer reincorporated into the corporate accounts, and the reduced rate applicable in this case is abolished. Other costs deductible at a rate of 120% are deductible up to 100%.

- Other measures that will only become effective in 2020 concern notably the possibility to convert exempted reserves (created before 2017) into taxed reserves at a favourable tax rate, and changes in the depreciation regime: the double-declining balance method will be abolished and, as with large enterprises, for the year of investment, SMEs will only be entitled to apply a prorated deduction.

Program Act of 25 December 2017 (Official Gazette of 29 December 2017)

- Belgian tax on savings income (art. 19bis ITC): currently, capital gains realised on shares or units of capitalising collective investment funds investing more than 25% of their assets in debt claims are subject to a withholding tax of 30%. Under the new rules, the 25% threshold is reduced to 10% while the investment funds in scope are extended to alternative funds not only investing in securities. These changes are applicable to income paid in relation to fund shares/units acquired as from 1 January 2018.

- Contractual investment funds (FCPs/GBFs): the application of the Belgian tax on savings income (art. 19bis ITC) on contractual investment funds investing in investment companies that themselves fall within the scope of this tax is aligned to the tax treatment of a direct investment in such investment companies. This measure comes into force as from its publication in the Belgian Official Gazette.

- The threshold for the traditional withholding tax exemption on interest received on savings deposits is decreased from EUR 1,880 to 940.

- To stimulate investment in shares, the government provides a new withholding tax exemption for Belgian and foreign dividends up to a threshold of EUR 627, the so-called Michel-De Croo measure; most dividends can benefit from the measure. Dividends distributed by collective investment undertakings through investment funds and legal structures are excluded. The taxpayer can choose the dividends to which the exemption applies, and the exemption has to be applied for via the tax return. The amount is increased to EUR 800 (after indexation) for dividends paid as from 1 January 2019 (assessment year 2020) (amending law).

- Tax on stock exchange transactions: as from 2018, the rates increase from 0.09% to 0.12%, and from 0.27% to 0.35%.

- The Cayman tax has been amended at various levels so as to increase its effectiveness and close some existing loopholes. Changes are in place to target intermediate structures. Distributions made by legal structures without legal personality (e.g. trusts) become taxable except if they have been already taxed. This measure applies as from 17 September 2017. Some exclusions are better outlined, particularly the substance exclusion. ‘Fonds dédiés’ as well as ‘de facto’ associations (labour unions) having foreign investment income fall within the scope of the tax.

The changes apply to income received, granted or paid as from 1 January 2018.

Act of 26 March 2018 Promoting Economic Growth (Official Gazette of 30 March 2018)

- Promotion of growth companies: The tax shelter for start-up companies providing for a tax credit is extended to growth companies under similar conditions. A growth company is a non-quoted small company in the meaning of article 15 of the Companies Code, aged between 5 and 10 years, and having at least 10 employees. To be in scope of the new measure, the turnover or the workforce of the growth company should have increased by at least 10% per assessment year in the last 2 assessment years preceding the investment. The qualifying investment is limited to EUR 100,000 per taxable period and per person, leading to a tax credit of 25%. Growth companies can only receive maximum EUR 500,000 on the basis of this measure (or EUR 250,000 if they have already received EUR 250,000 as a start-up). These thresholds are maximum amounts applicable for the tax shelter for growth companies and for start-ups combined. Subject to certain conditions, also non-residents could benefit from this measure.

- The regulatory framework of the private PRICAF has been reviewed and made more attractive, for instance, by relaxing the rules in terms of limited duration, control and management activity.

Furthermore the minimum investment threshold of EUR 100,000 is decreased to EUR 25,000 (Royal Decree still to be published). Also in the Income Tax Code some provisions in relation to private PRICAFs are relaxed or clarified. For instance, to apply the capital gains exemption on private PRICAF shares, the condition regarding ‘additional or temporary investments’ is aligned with the concept as couched in the regulatory legislation. It is also clarified that the annuality principle (i.e. the year-on-year nature of tax) applies for the special corporate income tax regime of private PRICAFs. In addition, for private investors, a new tax credit of 25% is introduced to partly cover the capital loss realised upon liquidation of private PRICAFs constituted as from 1 January 2018. The eligible capital loss is limited to EUR 25,000 per taxable period. Furthermore, the reduced dividend withholding tax rates of 20% or 15% are made applicable to dividend distributions by private PRICAFs provided that the underlying shares meet the conditions of the VVPR regime.

Act of 7 February 2018 introducing an annual tax on securities accounts (Official Gazette of 9 March 2018)

Holders of one or more securities accounts in Belgium or abroad with total assets equal to or exceeding EUR 500,000 are subject to tax at a rate of 0.15% of the average value of the total amount of taxable assets. The taxable assets are the following: funds, quoted or unquoted bonds, “kasbons”/“bons de caisse”, warrants, share and bond certificates, quoted shares and unquoted shares registered in securities accounts. Registered shares registered in the share register, pension savings accounts and life insurance are excluded. However, an anti-abuse rule has been introduced to include in the scope of the tax taxable assets that were converted into non-taxable assets on or after 9 December 2017. Another specific anti-abuse measure is introduced to tackle the contribution of securities accounts to legal entities. The average value will be calculated on the basis of a reference period (1 October to 30 September). In the case of joint ownership, the securities account is deemed to be held by the holders for equal parts. Corrections can be made on the basis of supporting documents. In principle, the tax will be collected by the financial institution that will also determine the value of the accounts concerned. The withholding is automatic when the holder has a securities account equal to or exceeding EUR 500,000 with a financial institution and when the holder who has securities accounts with several financial institutions has opted for the tax withholding to be operated by the institution because he may reach the taxable threshold. In other cases, it is for the holder to file the tax return, determine the tax amount and make the payment. The securities accounts will also have to be reported in the personal income tax return. Penalties will be applicable if the compliance obligations regarding the tax return are not met, in the case of late payment of the tax or if the holder does not provide the information requested by the tax authorities. This tax entered into force on 10 march 2018.

Act of 9 February 2017 introducing the Innovation Income Deduction (Official Gazette 20 February 2017)

- Qualifying intellectual property

- Innovation income

- Modified nexus approach

- Tracking and tracing

- Grandfathering and entry into force

Qualifying intellectual property

As from now, qualifying intellectual property (IP) income is called ‘innovation income’, which reflects the broader scope of the qualifying income. The Innovation Income Deduction (IID) can apply to income derived from the following intellectual property (IP) of which the company or branch has the full ownership, co-ownership, usufruct or license or rights to use on:

- patents and supplementary protection certificates;

- breeders’ rights requested or acquired as from 1 July 2016;

- orphan drugs, i.e. a drug to treat rare diseases, (limited to first 10 years) requested or acquired as from 1 July 2016;

- data and market exclusivity granted by the competent authorities (e.g. market exclusivity for orphan drugs or data exclusivity for reports with respect to pesticides, clinical studies of generic or animal drugs);

IP of copyrighted software resulting from a research or development project as defined for the purposes of the partial exemption of wage withholding tax for research and development and which has not yet generated income before 1 July 2016.

Under the PID system, the benefit was only available as from the year the patent was actually granted.

The benefit under the IID will also be available by way of a temporary exemption (which will lead to a permanent exemption once the qualifying IP right has been granted) as from the date the qualifying IP right has been applied for. As the copyright of software automatically exists without request (provided conditions are met), there is no temporary exemption in this respect.

All marketing related intangibles such as trademarks will not qualify for tax benefits under the IID system.

Innovation income

Without making any restrictions to SMEs, the following income will be considered as derived from the above qualifying IP in so far as the remuneration is included in the Belgian taxable result of the Belgian company or branch concerned:

- licence fees;

- IP income embedded in the sales price of own manufactured products for which a third party would be willing to pay a license (so-called ‘embedded’ royalties);

- IP income derived from process innovation;

- indemnities on the basis of a court/arbitral decision, an amicable settlement or an insurance settlement.

Furthermore, also the proceeds from a transfer of qualifying IP are in the scope of the deduction, subject to a reinvestment condition to be met within 5 years.

For the first taxable period during which the IID will be applied, the (net) innovation income should be decreased with the overall expenditure incurred during (preceding) taxable periods ending after 30 June 2016. Alternatively, one can opt to spread this recapture on a straight line basis during a period of maximum 7 years. In the case that the qualifying IP right terminates or is alienated before the end of this 7-year period, a correction will apply in order to limit the IID actually applied to the amount that would have been applied if no spread recapture had been opted for.

Modified nexus approach

In consideration of avoiding that the Belgian IID regime would appear to constitute a harmful tax practice, the modified nexus approach has to be taken into account. The nexus approach intends to ensure that, in order for a significant proportion of innovation income to qualify for benefits, a significant proportion of the actual research and development (R&D) activities must have been undertaken by the taxpayer itself.

As a matter of business practice, unlimited outsourcing to related parties or acquisition of IP from related parties should not provide many opportunities for taxpayers to receive benefits without themselves engaging in substantial activities.

Given the above, the IID will be determined by multiplying the innovation income with the below ratio. The fraction represents the ratio between the own R&D activities and the outsourced R&D activities/acquired IP (towards/from related parties). As such, the taxable result of a Belgian company or branch will be reduced by 85% of the total net innovation income after this fraction has been applied.

Important to note is that the ratio will be calculated on a net basis implying that (contrary to the PID regime) current-year deducted overall expenditure should be deducted from the current-year qualifying innovation income.

It is thereby also provided that any excess deduction that cannot be used due to insufficient taxable basis can be carried forward (without any limitation in amount or time) to be compensated with future taxable profits (contrary to the PID system).

Furthermore, the law provides for continuity of the IID in the case of tax neutral reorganisations (e.g. contribution, merger or (partial) demerger). This continuity is also foreseen now for the PID.

Qualifying expenditure

The qualifying expenditure is the expenditure incurred by the company itself or the compensation for expenses of non-related companies in relation to outsourced R&D activities.

Qualifying expenditure must be directly connected with the qualifying IP. The expenditure does not include interest payments, costs related to immovable assets or any costs that could not be directly linked to a specific intangible. If R&D activities are outsourced to a non-related company via a related company, the related costs will qualify as qualifying expenditure on the condition that the compensation is charged without mark-up (i.e. as a disbursement). Based on the OECD Report on Action Point 5, the total acquisition cost related to qualifying intangible property should not be taken into account as qualifying expenditure but should be included in the overall expenditure.

Uplift of the qualifying expenditure

The qualifying expenditure may be uplifted by 30%, with a maximum of the overall expenditure. This means that the uplift may increase the qualifying expenditure but only to the extent that the taxpayer has non-qualifying expenditure. The purpose of this uplift is to ensure that the nexus approach does not penalise taxpayers excessively for acquiring IP or outsourcing R&D activities to related parties.

In exceptional circumstances, it can occur that although an uplift of 30% is added, the nexus ratio does not represent reality. As such, the modified nexus ratio can be rebutted by the taxpayer if the ratio as set out above (excluding the uplift) equals or exceeds 25%. A higher ratio may be applied in case the taxpayer proves that the outcome of the ratio between self-performed activities for R&D and the total R&D activities does not reflect reality. A ruling should be obtained in this respect.

Overall expenditure

The overall expenditure in the denominator of the ratio includes the qualifying expenditure increased with the acquisition costs related to qualifying intangible property and the expenditure for related-party outsourcing.

Tracking and tracing

Since the nexus approach depends on there being a nexus between expenditure and income, taxpayers will have to carefully track and trace the expenditure, qualifying IP and income. In this respect it is provided that supporting documentation will have to be kept available for the tax authorities (such as the gross amount of the income, the actual value of IP acquired from a related company, the overall expenditure of the current year and the qualifying and overall expenditures over the life time of the IP).

In practice, it can be predicted that this will not be that easy to manage and may imply a cumbersome administrative burden for Belgian taxpayers. A transitional period is provided up to and including tax year 2019 (financials years ending as of 31 December 2018 until 30 December 2019, both dates inclusive). More detailed information with respect to this tracking and tracing and the timing thereof will be further determined by Royal Decree.

Grandfathering and entry into force

The new system enters into force as of 1 July 2016, so a taxpayer may apply the PID in the first 6 months of 2016 and the IID in the last 6 months. Taxpayers benefitting from the PID regime or taxpayers that requested or acquired a patent prior to 1 July 2016, will be able to choose for the PID or the IID regime and will be able to receive the benefits under the PID for another five years (grandfathering until 30 June 2021).

The choice for the PID is irrevocable and must (in principle) be made per IP right.

Individuals - Personal income tax

Latest update: 31 July 2018

On 24 July 2018 the federal government reached a social and labor “summer agreement” (so-called jobsdeal) containing some tax measures, such as changes to employer’s tax reporting obligations of some equity incentives.

At the end of 2017, the Corporate Income Tax Reform Act and the Program Act have introduced an important tax reform package, which takes effect over a three-year period (2018, 2019 and 2020). As key component of this package, the corporate income tax rate is being gradually reduced to 25% in 2020. On 19 July 2018, the Chamber passed a draft law amending and supplementing the Corporate Income Tax Reform Act and the Program Act (“Act on Various Income Tax Provisions”, hereinafter referred to as “the amending law”).

From a personal tax point of view, the following measures are or would be introduced.

Mobility budget

Following the introduction of the mobility allowance (“cash for car”), the government also started working on a mobility budget, which is actually the next step in the effort of reducing the number of cars on the Belgian roads. At this point in time no texts are available and only a communication of the Minister of Finance is available.

It is anticipated that the mobility budget – if adopted by the parliament – will co-exist with the recently introduced mobility allowance. Where the mobility allowance can only be granted under the beneficial tax and social security treatment if an employee hands in his/her company car, the announced mobility budget allows the employer to provide a company car and other ways of transportation for commuting simultaneously.

The amount of the mobility budget will be based on the “total cost of ownership” (TCO) of the company car for the employer. This is the total cost, on a yearly basis, which the employer bears for providing a company car to the employee, including the cost for fuel, insurances, taxes, maintenance, … .

The main conditions for implementing the mobility budget are foreseen to be the same as for the mobility allowance. It is anticipated that similar anti-abuse legislation will be included as well.

When an employer chooses implements a mobility budget, the employee will have the possibility to opt for a smaller, more eco-friendly and potentially cheaper model (under the existing car policy of the employer). The new, more eco-friendly car will be treated in the same way as any other company car, meaning that there is a taxable benefit in kind in the hands of the employee, a limitation of the corporate cost deductibility for the employer based on the CO2 emission of the car and a CO2 contribution due.

For the remaining part of the mobility budget to which the employee is entitled, he/she can choose for alternative (and more sustainable) means of commuting, such as a subscription for using public transportation, for a system of car sharing, … or even for receiving a biking allowance and use a bike for (a part of) his commute. It is foreseen that this part of the budget can be provided tax free and would be fully deductible for the employers.

In case there is still budget available (after switching the current company car for a smaller model and/or making use of alternative means of transportation) the employee can have this remaining part paid out in cash. It is anticipated that this payment will only be subject to Belgian social security contributions, 25% for the employer and 13,07% for the employee.

Act of 30 March 2018 introducing a mobility allowance (Official Gazette 7 May 2018)

The Act introducing the Mobility Allowance (“Cash for car”) offering the employees a cash alternative for their company car has been published in the Official Gazette. As of 1 January 2018, employees (who already use a company car) can be given the choice to exchange their current company car for a cash compensation, provided that both parties (employer and employee) agree to do so. As it is a voluntary scheme, the employer needs to decide to offer this possibility (and determine the conditions within the provisions of the law) and the employee can opt (voluntarily) to apply for this scheme.

Employers who are interested in offering this choice to their employees will be bound by some restrictions foreseen in the law. The introduction of this scheme is only possible for instance if the employer has been providing company cars to its employees for a minimum period of 3 years (36 months). There is an exception for starting companies. Furthermore, it is required that the employees (who request to switch from a company car to a mobility budget) have been provided with a company car for a period of at least 12 months in the past 36 months, of which 3 consecutive months prior to requesting a mobility budget.

The corresponding cash amount (that employees will receive for no longer having the private use of a company car) is set at 20% of 6/7 of the catalogue value of the car handed in. This amount will be subject to indexation. If the employee also had a fuel card at his/her disposal, the mobility allowance is increased by 20% (24% of 6/7 of the catalogue value of the handed in).

As it is currently the case for the benefit in kind of a company car, no employee’s social security contributions is due in the hands of employees who receive a mobility allowance. Furthermore, in most cases employees with a mobility allowance will face a lower tax burden as they will become taxable on an amount which is determined by taking into account 4% of 6/7 of the catalogue value of the car handed in (which will is likely to be lower than the taxable amount of the benefit in kind of the company car). The taxable amount is also subject to indexation. The cash amount of the mobility allowance exceeding this amount is exempt from social security contributions and taxes for the employees. The amount paid by the employer is subject to the same CO2 contribution as the car handed in and will be tax deductible for the employer for 75% up to 90%.

Because the mobility allowance may not be used to replace ‘ordinary salary’ or ‘other benefits’, several anti-abuse measures are implemented.

The mobility allowance is introduced as of 1 January 2018 and will be subject to evaluation after one year.

Act of 26 March 2018 Promoting Economic Growth (Official Gazette of 30 March 2018)

- Pension savings are further encouraged by adding a second option to the tax reduction system: the existing system of pension savings provides for a 30% tax reduction calculated on a maximum amount of EUR 940 per year (tax reduction of up to EUR 282). Going forward, a second system would be introduced which will allow taxpayers to obtain a 25% tax reduction (instead of the current 30%) on a maximum savings amount of EUR 1,130 (instead of the current EUR 940) (tax reduction of up to EUR 282.50). Taxpayers have to choose between both systems. If the taxpayer pays an amount equal to or lower than the maximum amount, he obtains the tax reduction related thereto. If the taxpayer makes an additional contribution higher than EUR 940 or EUR 1,130, the bank repays the difference between his contribution and the maximum amount depending on the option he has chosen.

- Lump-sum amount for business expenses: up to now, self-employed people who received profits, have to produce evidence for their actual business expenses. As from 2018, they would be able to use a lump-sum amount of business expenses. This lump sum amount will be calculated using a unique rate of 30% with a maximum of EUR 2,950. The lump sum amount would not include the purchase price of the goods nor the personal social contributions.

- Promotion of growth companies: the tax shelter for start-up companies providing for a tax credit is extended to growth companies under similar conditions. A growth company is a non-quoted small company in the meaning of article 15 of the Companies Code aged between 5 and 10 years and having at least 10 employees. To be in scope of the new measure the turnover or the workforce of the growth company should have increased by at least 10% by assessment year in the last 2 assessment years preceding the investment. The qualifying investment is limited to EUR 100,000 per taxable period and per person, leading to a tax credit of 25%. Growth companies can only receive maximum EUR 500,000 on the basis of this measure (or EUR 250,000 if they already received EUR 250,000 as start-up). These thresholds are maximum amounts applicable for the tax shelter for growth companies and for start-ups combined. Subject to certain conditions, also non-residents could benefit from this measure.

- For private investors a new tax credit of 25% is introduced to partly cover the capital loss realised upon liquidation of private PRICAFs constituted as from 1 January 2018. The eligible capital loss is limited to EUR 25,000 by taxable period. Furthermore, the reduced dividend withholding tax rates of 20% or 15% are made applicable to dividend distributions by private PRICAFs to the extent that the underlying shares comply with the conditions of the VVPR regime.

- Other: The same law also provides for a number of other changes such as: 1. Increase of the tax free amount for single parents with limited income; 2. Tax exempted amount for starters-youngsters; 3. Broadening of the wage withholding tax exemption for shift work; 4. Tax exemption for income from community work, occasional services between citizens and the ‘sharing economy’.

Program Act of 25 December 2017 (Official Gazette of 29 December 2017)

Participation in the company’s profits: This measure consists in allowing the employees (not applicable to self-employed company directors) to participate in the company profit, without having to hold a share in the company’s capital. This measure is optional and not mandatory for the companies.

The maximum amount of the profit participation is limited to 30% of the total wage bill (‘masse salariale’/’loonmassa’) and consists in a fixed amount or fixed percentage of the employee’s salary (‘general’ profit participation premium). It is not allowed to use the profit participation as a replacement for salary. Finally, the profit participation bonus is not taken into account for calculating the payroll standard (which determines the maximum margin of increase in wage costs in the private sector and in certain State-owned enterprises).

The employee is liable to pay a special social security contribution of 13.07% on the one hand and a profit premium tax of 7% on the other hand.

The employer has not to pay special employer’s social security contributions. However, the profit participation premium will be treated as a disallowed expenses for corporate tax since this premium is not considered to be salary and is therefore not deductible.

Comparing the profit participation to the CAO90 bonus, some differences need to be taken into account. The CAO90 bonus is subjected to a special solidarity contribution of 13.07% by the employee (cfr. profit participation premium) but is tax exempted up to a certain level resulting in a higher net amount for the employee.

However, the profit participation premium is intended to be less complex to implement. For example, no agreement of the labour unions is in principle needed when a ‘general’ profit participation premium is granted (if the same amount for each employee is used).

Also, the maximum amount of the profit participation premium that can be granted to an employee is much higher than the CAO bonus (30% of the total salary mass instead of an absolute maximum of 3.255 before deduction of solidarity contribution).

Belgian tax on savings income (art. 19bis ITC): currently, capital gains realized on shares or units of capitalizing collective investment funds investing more than 25% of their assets in debt claims are subject to a withholding tax of 30%. Under the proposed rules, the 25% threshold is reduced to 10% while the investment funds in scope are extended to alternative funds not only investing in securities. These changes are applicable to income paid in relation to fund shares/units acquired as from 1 January 2018.

Contractual investment funds (FCP/GBF): the application of the Belgian tax on savings income (art. 19bis ITC) to contractual investment funds investing in investment companies, which themselves fall within the scope of this tax, is aligned to the tax treatment of a direct investment in such investment companies. This measure enters into force as from the publication in the Belgian Official Gazette.

- The threshold for the traditional withholding tax exemption on interest received on savings deposits is decreased from EUR 1,880 to 940.

- To boost investments in shares, the government provides a new withholding tax exemption for Belgian and foreign dividends up to a threshold of EUR 627, the so-called Michel-De Croo measure; most dividends can benefit from the measure. Dividends distributed by collective investment undertakings through investment funds and legal structures are excluded. The taxpayer can choose the dividends to which the exemption applies, and the exemption has to be applied for via the tax return. The amount is increased to EUR 800 (after indexation) for dividends paid as from 1 January 2019 (assessment year 2020) (amending law)

Tax on stock exchange transactions: as from 2018, rates increase from 0.09% to 0.12% and from 0.27% to 0.35%.

The Cayman tax has been amended at various levels so as to increase its effectiveness and close some existing loopholes. Changes are in place to target intermediate structures. Distributions made by legal structures without legal personality (e.g. trusts) become taxable, except if they have been already taxed. This measure applies as from 17 September 2017. Some exclusions are better outlined, particularly the substance exclusion.

‘Fonds dédiés’ as well as ‘de facto’ associations (labour unions) having foreign investment income (trade unions) fall within the scope of the tax.

The changes apply to income received, granted or paid as from 1 January 2018

- Reduction of tax benefits: The Act provides for a reduction of tax benefits granted to people for whom the taxable period does not correspond to a full calendar year (e.g. people who leave Belgium – there is an exception foreseen in case of decease). In such case, certain tax benefits are granted on a pro rata temporis basis only. This is the case e.g. for tax residents of Belgium who leave Belgium in the calendar year and stop being tax residents during the year. A number of tax reductions (e.g. lump-sum business expenses, marital quotient, etc.) and deductions (e.g. tax-free amount, pension savings, etc.) will only be granted on a pro rata basis going forward. For Belgian non-residents, similar provisions and specific limitations have been introduced. These measures are applicable as from assessment year 2018.

Act of 7 February 2018 Introducing an Annual Tax on Securities Accounts (Official Gazette of 9 March 2018)

- Holders of one or more securities accounts in Belgium or abroad with total assets equal to or exceeding EUR 500,000 are subject to tax at a rate of 0.15% of the average value of the total amount of taxable assets. The taxable assets are the following: funds, quoted or unquoted bonds, “kasbons”/“bons de caisse”, warrants, share and bond certificates,quoted shares and unquoted shares registered in securities accounts. Registered shares registered in the share register, pension savings accounts and life insurance are excluded. However, an anti-abuse rule has been introduced to include in the scope of the tax taxable assets that were converted into non-taxable assets on or after 9 December 2017. Another specific anti-abuse measure is introduced to tackle the contribution of securities accounts to legal entities. The average value will be calculated on the basis of a reference period (1 October to 30 September). In the case of joint ownership, the securities account is deemed to be held by the holders for equal parts. Corrections can be made on the basis of supporting documents. In principle, the tax will be collected by the financial institution that will also determine the value of the accounts concerned. The withholding is automatic when the holder has a securities account equal to or exceeding EUR 500,000 with a financial institution and when the holder who has securities accounts with several financial institutions has opted for the tax withholding to be operated by the institution because he may reach the taxable threshold. In other cases, it is for the holder to file the tax return, determine the tax amount and make the payment. The securities accounts will also have to be reported in the personal income tax return. Penalties will be applicable if the compliance obligations regarding the tax return are not met, in the case of late payment of the tax or if the holder does not provide the information requested by the tax authorities. This tax entered into force on 10 march 2018.

Corporate income tax reform Act of 25 December 2017 (Official Gazette 29 December 2017)

Reimbursements of paid-up capital: The reimbursement of capital is deemed to derive proportionally from paid-up capital and from taxed reserves (incorporated and non-incorporated into capital) and exempted reserves incorporated into the capital. The reduction of capital will be allocated to paid-up capital in the proportion of the paid-up capital in the total capital increased by certain reserves. The portion allocated to the reserves is deemed to be a dividend and become subject to withholding tax (if applicable). Share premium distribution is submitted to the same system.

Exempted reserves not incorporated into the capital remain beyond of the scope of the rule.

Some elements such as revaluation surplus, provisions for liabilities and charges, unavailable reserves, etc. have to be withdrawn from the reserves taken into account to calculate the coefficient. A sequence of allocation has been provided if the amount of the paid-up capital and sums being treated as capital are insufficient. This change is applicable to capital reduction decided by a general meeting as from 1 January 2018.

Company cars: From a personal income tax point of view, tax deduction of costs linked to cars is brought into line with the rules applicable to companies as from 1 January 2018. This implies changes regarding the rate of deductibility (which will be linked to the CO2 emission), the capital gains tax on cars, the depreciation regime, etc. However, for individuals, a minimum deduction of 75% remains applicable for cars bought before 1 January 2018.

In general, under the current system (applicable to companies), the deductibility rate of car costs in the hands of Belgian companies and Belgian PEs varies in a range between 50% and 120% of the costs, depending on the type (fuel) and CO2 emission of the company car. The deduction for fuel costs is set at 75%.These rules change as follows:

- The deductibility rate of car costs will be linked to the actual CO2 emission level of the car, and will range between 50 and 100% according to the following formula: 120% - (0,5% x coefficient x gr CO2/km). The coefficient is equal to 1 for vehicles with diesel motor and equal to 0,95 for vehicles with another motor. For highly polluting cars, the deductibility is limited to 40%. A highly polluting car is a car with a CO2 emission of 200 grams or more.

- Under the current rules, car costs for so-called ‘fake’ hybrid cars can easily be deductible at 90 or 100% because of the posted low CO2 emission level. According to the new rules, ‘fake’ hybrid cars are vehicles with a fuel engine and a rechargeable electric battery with an energy capacity lower than 0,5 kWh per 100 kg of vehicle weight, or with a CO2 emission level of more than 50 gr/km. Under the new rules, the deductibility is brought into line with the tax treatment of its non-hybrid counterpart. By lack of corresponding car, the CO2 emission value will be multiplied by 2,5. Transitional rules are provided. However, the current system continues to apply to hybrid cars acquired before 1 January 2018.

- Taxable benefit in kind for “fake hybrid cars”: under the current rules, the benefit in kind for hybrid cars is calculated on the same basis as for regular cars and takes into account the posted low CO2 emission level. Depending on the battery capacity of the car (in relation to the weight of the car), a rechargeable hybrid car qualifies as a ‘fake’ hybrid car or not. Under the new rules, the benefit in kind is calculated using the same CO2 emission norm as its non-hybrid counterpart. By lack of such corresponding car, the CO2 emission value will be multiplied by 2,5.

- The deduction for fuel costs will no longer be fixed (at 75%) but will also be linked to the CO2 emission of the car.

- Costs in relation to electric cars are only deductible up to 100%, instead of 120%.

Indirect Taxes

Latest update: 11 May 2018

VAT

Belgian VAT update

The Belgian government reached an agreement that as from the 1 October 2018 the parties would be able to opt to charge VAT on the leasing of the immovable property. Both landlord and tenant need to mutually agree on the option to apply VAT and the tenant needs the use the immovable property for its economic activity. The possibility to apply VAT on lettings would be open to projects as of 1 October 2018. Moreover, the VAT adjustment period on eligible properties will in such case be extended from 15 years to 25 years.

Along with the introduction of the option to tax, short-term leasing of maximum 6 months would also will de iure be subject to VAT in both a B2B and B2C-context.

Remark : The above announced measure are subject to change.

EU VAT udpate

Following the VAT action plan as launched in 2016, the EU Commission published a Proposal for the Definitive VAT system for Cross Border EU Trade.The aim of the Proposal is to improve and modernise the current VAT system. This should reduce VAT fraud and simplify doing business within the EU Single Market. When adopted, the rules as we currently know them will change dramatically. This will cause a substantial impact, particularly for business active in the goods trade business.

The key points of this Proposal for a definitive VAT regime are:

- Implementation of the principle of taxation at destination for intra-EU cross-border supplies of goods. Under this principle the VAT rate of the Member State of destination is applicable.

- Change of the liability to pay the VAT due to the supplier/seller in the case of an intra-EU supply of goods as a general rule (under the current rules the customer is liable for the VAT due for such transactions).

- Extension of the One Stop Shop. Businesses will be able to make declarations, payments and deductions for cross-border supplies of goods through a single online portal, as is already the case for the supply of e-services.

- Introduction of the concept of a Certified Taxable Person (CTP): A business can apply to its national tax authority and become a CTP by proving compliance with pre-defined criteria such as regular payment of taxes, internal controls and proof of solvency. Once certified, the company will be considered a reliable tax-payer.The CTP and the companies that do business with it will enjoy a number of simplified procedures for the declaration and payment of cross-border VAT. The status of CTP will be mutually recognised by all EU Member States.

Other taxes or tax measures

Tax on stock exchange transactions

As from 1 January 2015, the temporary increase of taxes on certain stock exchange transactions has become permanent. In addition, the tax rate of both secondary market transactions in shares and transactions in capitalisation funds is increased (for secondary market transactions in shares: increase to 0.27% with a maximum of EUR 800, for transactions in capitalisation funds: increase to 1.32% with a maximum of EUR 2,000).

Fight against fraud

The current fight against tax and social fraud would continue. Additional tax inspectors will be hired and trained by the Government.

In the framework of the budgetary control exercise in March 2015, the following measures in this regard were announced: ‘fiscal amnesty’ (for previously undeclared income), fight against abuse of corporate structures and online fraud, extension of data-mining projects, and better use of information concerning the 183 days rule.

The Belgian Minister of Finance also launched the ‘Plan to Combat Tax Fraud’ in December 2015, sharing new insights on how Belgium will be addressing the outcome of the OECD/G20 project in relation to Base Erosion and Profit Shifting (“BEPS”). A plea for coordinated actions in sync with global, OECD and EU initiatives as opposed to unilateral measures is a recurring theme that glimmers through the entire policy document.