Chapter 3: The Fundraising process: overview

Listen to the audio version here:

Once you have decided that venture capital is the right type of funding for your startup, you’ll need to understand the art and science of fundraising. In this blog post, we offer an overview of the different phases of the fundraising process. (We’ll dive deeper into it in future blog posts.)

The fundraising process

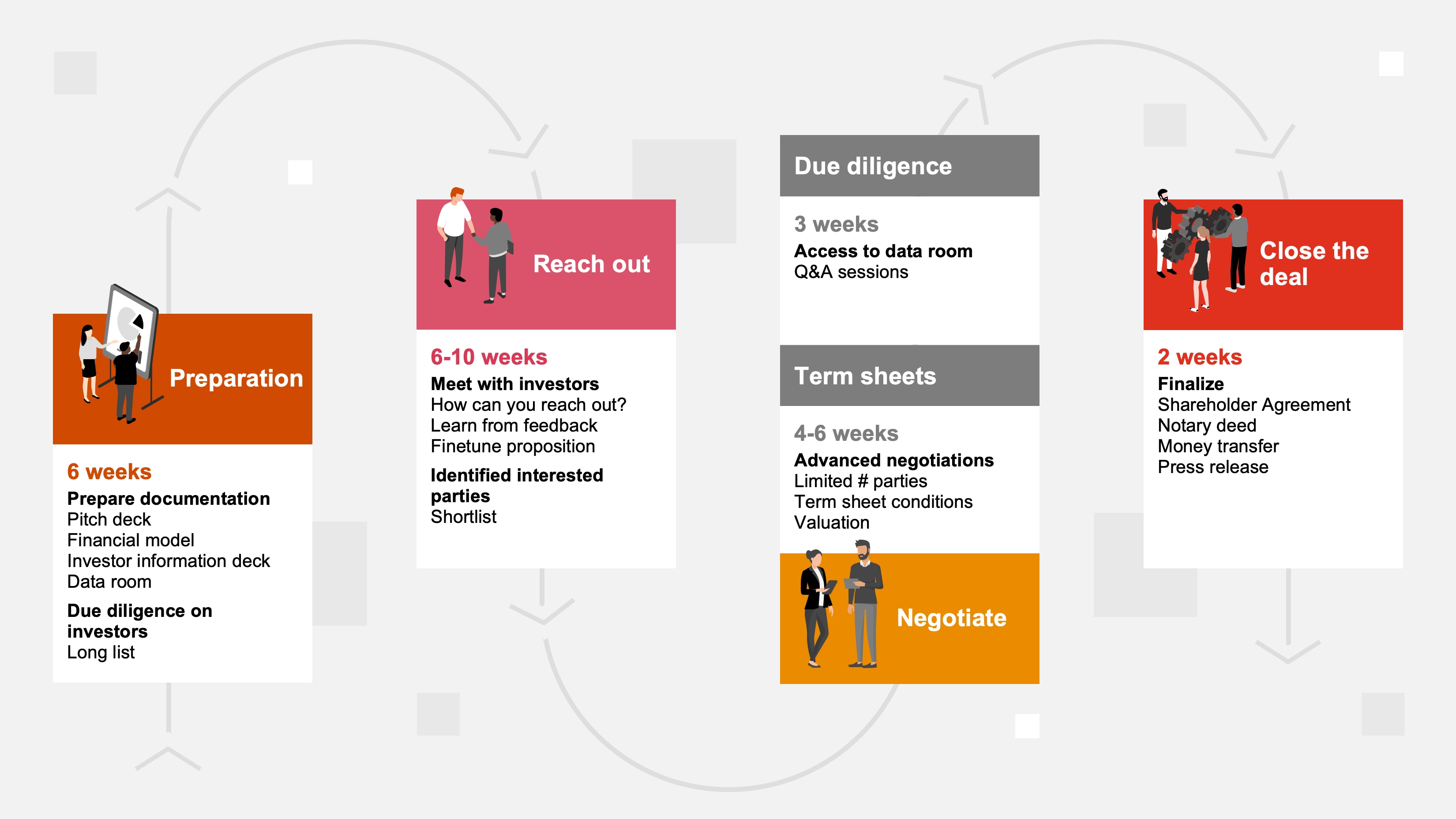

Generally, the fundraising process consists of 4 key phases (Figure 1).

Figure 1: Overview of the fundraising process

The entire process can last anywhere from 6 months to over a year depending on a variety of factors. Let's look at each of these phases.

Preparation — This phase involves the preparation of required documentation such as a pitch deck and investor information deck. In addition, it’s when you should fine-tune your financial model, research potential investors and start preparing your data room for a smooth due diligence process later on.

Reach out — During this phase, connecting with potential investors is key. The focus is on reconnecting with existing contacts and getting on the radar of new potential connections (preferably through personal introductions and reconnecting), getting meetings to present your pitch and sending over your investor information deck. The goal is to spark appetite and secure second and third meetings with investors you have a good fit with.

PwC Pro Tip

- Investor relations should be a priority even when not raising funds. Ideally, you put yourselves on the radar with investors a few months before you start to raise funds.

- Make sure to take time to reflect on feedback from first investor meetings. It could be valuable when further fine-tuning your pitch.

Negotiate — During this phase, more advanced negotiations with interested investors take place. Usually, by this phase, the investors that are still in the process have a sincere interest in investing in your company, and deal-structuring specifics such as valuation, governance and preferences are negotiated and summarised in a ‘term sheet’. Once the involved parties agree on a term sheet, a due diligence process is initiated. In this step, investors verify the information you’ve provided on historical financials, existing shareholder agreements and other obligations, technology etc.

Close the deal — If no ‘hidden skeletons’ are found during the due diligence phase, the next step is to close the deal! The term sheet is translated into a shareholder agreement, and any legally required administration (such as review by a notary in Belgium) should be fulfilled. Finally, the money is transferred to your account and your company is all set for growth.

Who should you involve during the fundraising process?

Fundraising is a time-consuming process and will require the full-time dedication of key individuals in your company. Ideally, the founder/CEO should lead the fundraising process, with the support of senior management (e.g. CFO, CTO, CMO, etc.). Although it’s not unusual for junior members of the team to be deeply involved in the fundraising process (especially in early-stage companies), it can send a bad signal to investors if senior management (especially the CEO) is not in the lead.

There are other key stakeholders in the fundraising process that you should be aware of. We’ve highlighted a few for each phase of the process.

Table 1: Key stakeholders in the fundraising process

| Fundraising process | Who should be involved? | Who could you involve? |

|---|---|---|

| Preparation |

|

|

| Reach out |

|

|

Negotiation |

|

|

| Close the deal |

|

|

In our next blog post, we’ll dive deeper into the preparation phase, and focus on how to prepare a good pitch deck.

For more information on how PwC can support you in your fundraising, visit our website.

Download the full PwC's fundraising whitepepaper here

How are VC funds organised?

Preparation phase

Preparing pitch and investor decks