E-commerce: IOSS service offering

What is the Import-One-Stop-Shop (IOSS)?

The Import One-Stop-Shop allows to collect, declare and pay the local VAT due via one monthly IOSS return in a single Member State for all the sales of goods of an intrinsic value not exceeding EUR 150, imported from third territories or third countries, to B2C customers (such as private individuals or taxable persons or non-taxable persons whose intra-Community acquisitions of goods are not subject to VAT). In addition, under this IOSS regime, the import is VAT exempt.

Interested in receiving PwC's digital and e-commerce newsletters?

Register here

What are the benefits?

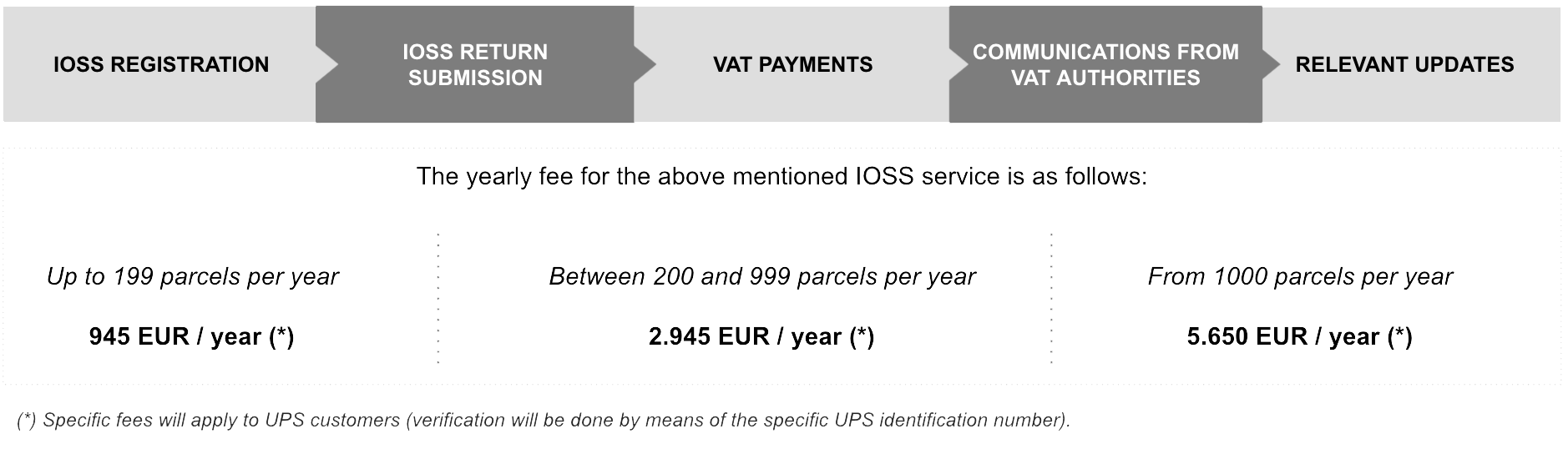

How can PwC assist with IOSS intermediary & compliance services?

Fee arrangement

FAQs

Any taxable person:

- - Who sells goods (excluding goods subject to excise duties) in parcels with a value below EUR 150

- - In a business to consumer relation, all sales to businesses (B2B) are excluded from IOSS

- - Which are transported directly from outside the EU to the customer within the EU

If you are not established in the EU you will need to appoint an intermediary to be able to use the IOSS scheme - this is included in our service offering. If you are established in the EU you do not need to appoint a representative.

For the IOSS the tax period is one calendar month and the return us to be submitted by the end of the following month

The payment of the VAT is due by the end of the month following the tax period

Yes to the extent you have not sold any goods during a given tax period - a nil VAT return will have to be submitted

No, said VAT is to be recovered through a so called 13th Directive refund procedure

Also return shipments will have to be included in the IOSS VAT return

Which VAT rate applies can be found here: https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html

Contact us