For easiness of reading, we will switch between global CEOs (i.e. all CEOs who have taken part in the survey, weighted proportionally to country nominal GDP to ensure geographical representation), health industry CEOs (HI CEOs), healthcare services CEOs (HCS CEOs) and pharma life science CEOs (PLS CEOs). Together the healthcare CEOs and pharma life science CEOs form the health industry CEOs.

Executive summary

Economic outlook: the health industry shows a positive short-term outlook, with HI CEOs confident in their revenue and growth forecasts, while simultaneously having long-term reservations, as about half of health industry CEOs believe their companies will not be viable in a decade without significant changes, emphasising the need for business model transformation. HI CEOs are actively reinventing their business models as survey findings indicate health industry companies are adapting, with a quarter of HI CEOs implementing new pricing models, targeting new customer bases or exploring new market routes in recent years.

Innovative solutions: the health industry sector is witnessing a change driven by innovations such as telehealth, smart wearables and home testing kits, which enhance personalised and preventative care and facilitate seamless interaction with healthcare providers, contributing to the shift of care from hospitals to more accessible retail locations. Also, artificial intelligence (AI) is driving innovation at all levels in the health industry with 32% of companies reporting that generative AI (GenAI) has delivered revenue increases in the past year, roughly a third noting improved profitability. GenAI is also transforming drug discovery, making it faster, more effective and cost-efficient.

Navigating the complexities of the health industry: A landscape of optimism

The survey reveals a distinct optimism among HI CEOs concerning economic growth (i.e. gross domestic product (GDP)) in the next 12 months, which stands out when compared against global counterparts. An impressive 66% of HI CEOs anticipate global economic growth in the coming year, compared to 58% of all surveyed CEOs. Which is a significant uptick compared to last year’s survey results when only 44% of HI CEOs and 38% of global CEOs expected economic growth in the next 12 months. A similar trend can be noticed when CEOs zoom in on the economic growth within their own territory, as 62% of HI CEOs versus 57% of the global CEO expect growth. This positivity is mirrored in their own company where 51% of HI CEOs anticipate workforce expansion in the next 12 months, well above the expectation of the global CEOs at 42%, and revenue projections were approximately half of HI CEOs (47%) are very or extremely confident that their company is well positioned for revenue growth, significantly better than the outlook of global CEOs (40%). The discrepancy between HI CEOs and global CEOs disappears when expanding the horizon of revenue growth prospects to the next 3 years, as both HI CEOs and global CEOs landed at 53%. Headcount growth in combination with navigating technological advances, business reinvention, M&A and more efficient processes will be the main drivers of this revenue growth as it will allow companies to capitalise on market opportunities.

Strategic directions: Innovation, expansion and M&A activities

A recurring trend in our recent M&A outlooks has been the focus on core business by HI companies as they have been divesting non-core business to optimise their use of available resources – both personnel and financial – when navigating a challenging macro-economic and regulatory environment and an increasing cost base (i.e. divest to invest)1. This strategic focus clearly came back in our survey results as 76% of the revenue for health industry companies in the last 5 years comes from their core business, another 17% comes from extensions to the core business (e.g. new locations or new product lines), leaving only 7% of revenue to come from fundamentally distinct business that companies have added during this 5-year period.

CEOs are continuously exploring potential new revenue avenues to further grow their topline. These could be sectors or industries in which they haven’t competed previously, extending the customer base by selling to consumers in new markets, opening new go-to-market routes by selling direct to consumers, …. In our survey, 30% of PLS CEOs and 25% of HCS CEOs indicated that they have started to compete in new sectors or industries over the last 5 years, compared to 38% of global CEOs. This has been worthwhile, as half of the PLS CEOs who responded yes to this question indicated that more than 20% of their revenue over the last 5 years came from these new sectors or industries such as health services, consumer markets or technology, which is well above the global average2. We believe that a dynamic reallocation of resources to re-invent how business is done, is a pre-requisite to unlock higher profitability. Over the last year, 7 out of 10 HI CEOs have reallocated less than 20% of their financial resources and 8 out of 10 have reallocated less than 20% of their human resources.

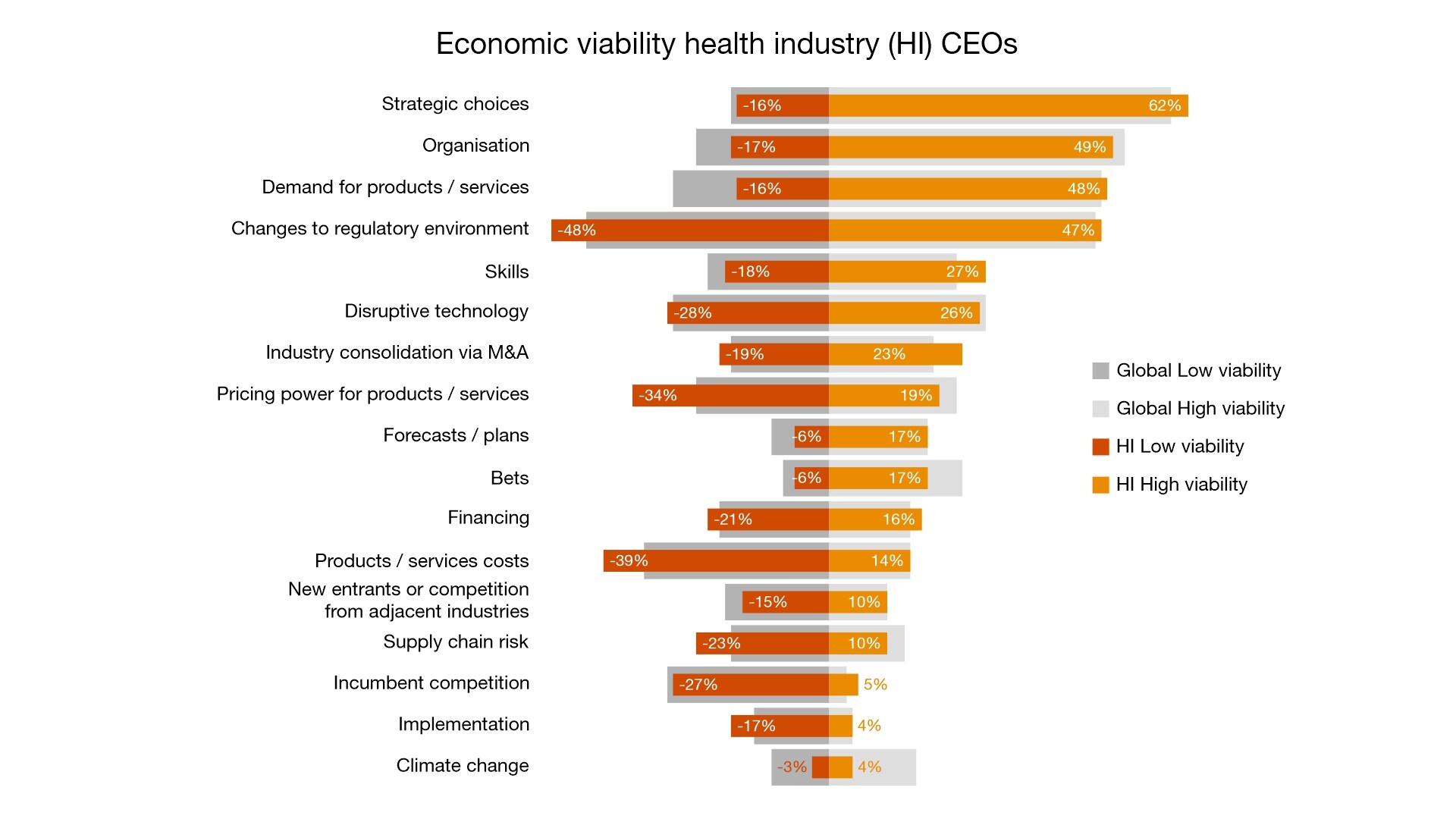

When CEOs reflect about their company’s economic viability in 10 years, 46% of HI CEOs are convinced that their company will not be economically viable if they continue to follow their current path. Taking into account our results from previous annual surveys, continual reinvention of the business model should be high on the agendas of CEOs as they are becoming less optimistic about their 10-year outlook. In 2023, 28% of pharmaceutical CEOs indicated that they would not be economic viable in 10 years if they continued its current path. This percentage increased to 38% in 2024 and further increased to 45% this year. To better understand this stance, we went deeper and asked CEOs to give their top 5 most influential themes that impact the viability of their company in the long run positively and negatively.

Boosters

The themes boosting the viability of HI companies are: (i) making the correct strategic choices (62%), (ii) efficient organisation (49%), (iii) increase in demand of their products/services (48%) and (iv) positive changes to the regulatory environment (47%).

Killers

The themes negatively impacting the long-term viability of their companies are: (i) negative changes to the regulatory environment (48%), (ii) increase in products/services costs (39%) and (iii) weak pricing power for their products/services (34%).

The regulatory environment is considered to be both a booster and a killer, as approximately half of CEOs believe it will significantly impact the viability of their company in the next years, either positively or negatively.

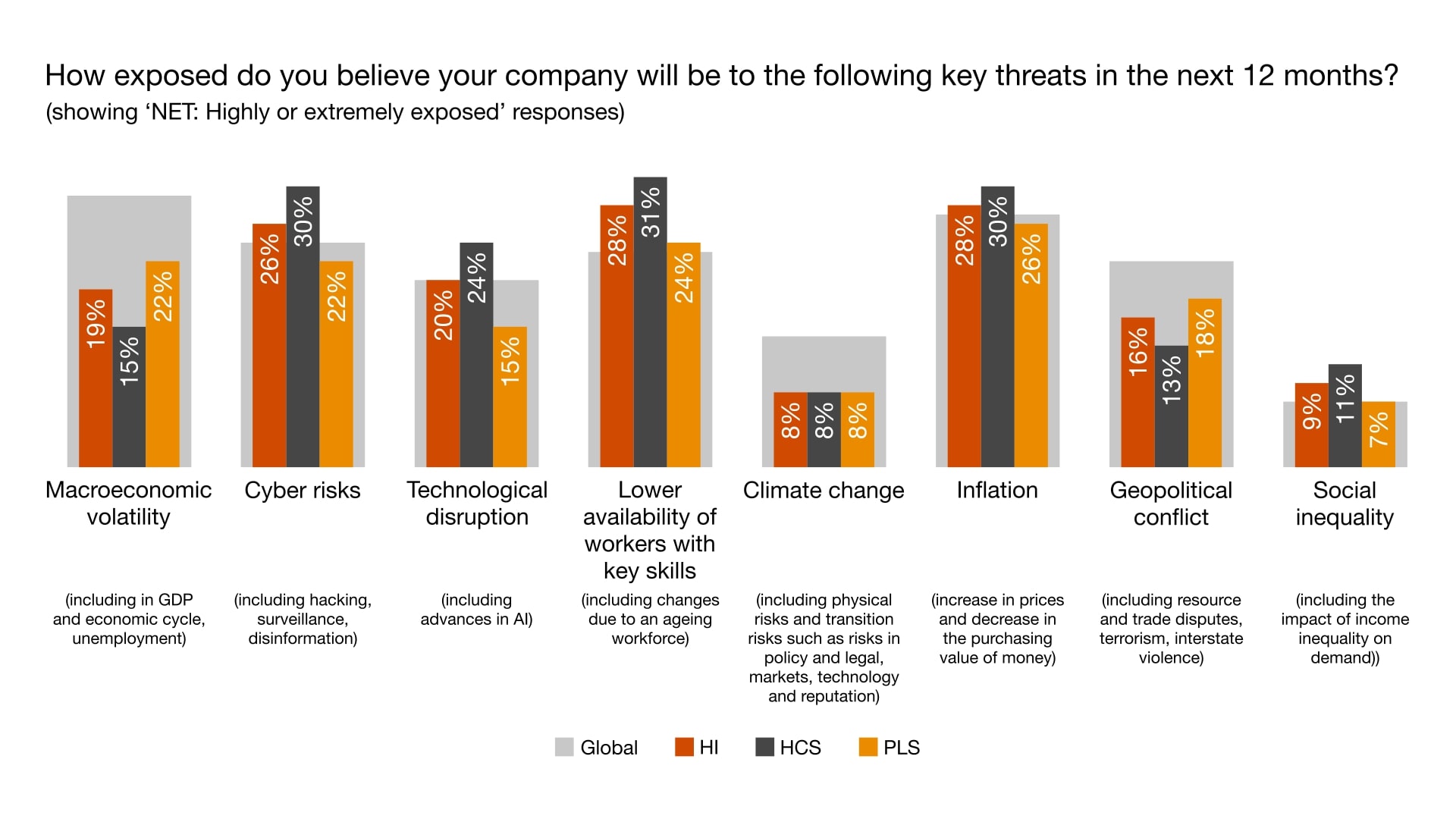

When looking at key threats, HI CEOs believe they are highly or extremely exposed to following top 3 threats: (i) lower availability of key people (28%), (ii) inflation (28%) and (iii) cyber risks (26%). In particular HCS CEOs are more concerned about these threats as they score significantly higher than both their pharma life science CEO peers and global CEOs. These threats continue to put pressure on healthcare service providers to find digital efficiencies that can help bridge the gap to high-quality care at a more affordable cost. Among half of CEOs, there is consensus that AI will play a role in the transition to more affordable care as more than half of HCS CEOs (57%) believe GenAI will increase the profitability of their company in the next 12 months, while 43% of PLS CEOs believe profitability will be pushed by GenAI.

On the other hand, HI CEOs believe they are less exposed to threats such as (i) geopolitical conflict (16%), (ii) social inequality (9%) and (iii) climate change (8%). Compared to their global peers, HI CEOs are more optimistic as about 1 out of 5 global CEOs believe they are highly or extremely exposed to this threat, compared to 1 out of 7 HI CEOs. We noticed a similar trend between global CEOs and HI CEOs concerning if they believe their company is highly or extremely exposed to climate change.

In terms of mergers and acquisitions, the survey reveals a cautious realism. Only 28% of HI CEOs have pursued a major acquisition in the past three years - a decrease from previous years where 33% of HI CEO indicated they made a major acquisition. However, looking forward, more than half of HI CEOs aim to engage in acquisitions within their current sectors. This strategic M&A focus reflects a keen awareness of optimising resources for sustainable, profitability-driven growth amidst fluctuating economic climates.

GenAI and sustainability initiatives: Embracing the future

GenAI has been recognised by a substantial portion of HI CEOs for its transformative potential. Over half of the HI CEOs report enhanced efficiency at both personal (57%) and organisational levels (53%) due to GenAI, with tangible impacts on both revenue (32%) and profitability (31%) within the last year. Looking forward, about half of HI CEOs (51%) believe that GenAI will boost their profitability in the next 12 months, in particular healthcare services CEOs expect that GenAI will increase their profitability in the next 12 months, compared to 43% of pharma life science CEOs. Yet, despite these advancements, trust in fully integrating GenAI into key processes remains limited at 33%, echoing sentiments among global CEOs and underscoring challenges in adoption and adaptation. Over the next 3 years, HI CEOs expect that GenAI will be systematically integrated in technology platforms (58%), business processes and workflows (42%), new product/services development (35%) and workforce and skills (31%). These estimates are in line with their global peers, with exception of the technology platforms where the HI CEOs are well above the global CEOs (58% vs. 47%).

Parallelly, sustainability remains a focal point, with HI CEOs actively investing in climate-friendly initiatives. Approximately 2 out of 10 HI CEOs reported that climate-friendly investments initiated in the last 5 years have decreased their costs, while another 4 out of 10 HI CEOs mentioned that climate-friendly investments had little to no change on their costs. In addition, only 17% of the HI CEOs have accepted a lower rate of return on their climate-friendly investments compared to the standard rate of return which is adhered to when an investment decision is made. When comparing healthcare services companies to pharma life science companies, we notice that PLS CEOs only had to accept a lower rate of return for 12% of their climate-friendly investments, which is below the average for global CEOs (25 %). Climate-friendly investments promise environmental benefits with no or limited downside and, in certain cases, have a positive impact on government incentives (20%) and revenue from products/sales (20%).

Would you like to discuss in more detail or to exchange thoughts?

Don't hesitate to reach out!

About the survey

Our CEO survey was conducted and completed prior to recent macroeconomic events which could significantly re-shape the health industry sector, such as the potential import tariffs on pharmaceutical products by the US.

Contact us