If Belgian citizens are known to have “a brick in the stomach”, there is something else they particularly enjoy – that’s company cars.

In our recent survey on the current state of employers’ mobility policies, we’ve delved into this long-standing custom in light of changing policy and increasing pressure on organisations to step up their sustainability game. How are organisations reacting to government pressure to swap their combustion engine fleets for electric ones? Are they actively implementing measures promoting multi-modal mobility?

Our study explores Belgium's evolving mobility landscape, marked by the persistent dominance of company cars, a strategic shift towards electric vehicles (EVs), and the emergence of new incentives for employees willing to ditch company cars altogether. Amidst growing concerns for sustainability and traffic congestion, we’ve explored how legal and tax reforms are reshaping organisational approaches to mobility and sheds light on complexities and future trajectories in the realm of employer mobility policies.

Key findings

1. Fleets are going green

With the Belgian government actively promoting electric cars through a 100% tax deduction of zero emission cars until 2026, employers are hard pressed to further the transition to electric cars-only fleets.

2. Early adopters vs. Sceptics

Respondents are split between two groups: pioneers that have already enacted the switch to fully electric cars, and those who are still working on a TCO (Total Cost of Ownership)-based policy.

3. Change managements as a turbo

Our research shows that the early adopters group has been able to realise the transition to full EV without large financial investments for the employees thanks to broad change management initiatives to onboard their workforce.

4. Multi-modal mobility is on a roll

Despite legal and practical challenges, more organisations begin designing and implementing a multimodal mobility plan. However, there is a clear distinction between the full electric policy group and the TCO-based policy group, with the former appearing to be more aware of the need to keep investing in mobility beyond the shift to electric to sustain the mobility policy in the long run in spite of increasing costs for cars.

5. Risks and legal uncertainties

Is it all sunshine and roses on the path to sustainable mobility in Belgium? Not really, as our survey reveals several hurdles that may negatively impact all parties in the coming years.

Fleets are going green

With a substantial workforce segment still engaging in traditional commuting, a beneficial tax treatment and an overall fleet that has doubled in size over the past 15 years, it is clear that company cars are not going anywhere anytime soon. And the Belgian government has been using this situation to its advantage: Tax measures are being used as a primary means to accelerate the greening of the Belgian car fleet.

We found that almost all organisations have adapted their car policy to the Total Cost of Ownership (TCO) as a reference for their car selection process. Meanwhile, the fact that cars with CO2 emissions will progressively see their deductibility decrease to 0% in 2026, coupled with a 100% deductibility incentive on zero emission cars, has already pushed about 60% of our panel to adopt a full electric car policy. Out of those remaining, 83% plan to make the switch in the near future.

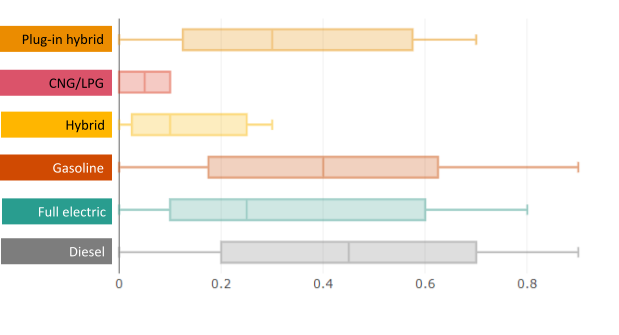

If the above chart shows that traditional combustion engines still range from 0 to 90% of the respondent’s fleets, these figures are bound to go down very quickly.

Distribution of car fleet over engine types

If the above chart shows that traditional combustion engines still range from 0 to 90% of the respondent’s fleets, these figures are bound to go down very quickly.

Early adopters vs. Sceptics

The results get even more interesting as we distinguish the group with a full electric policy from those working only with a TCO-based policy. Whilst the highest share of full electric vehicles (EV’s) goes up to 80% of the fleet in the full electric policy group, it only reaches 30% in the TCO-based policy group.

Behind these vastly different figures lie different approaches to change management. The full electric group tends to actively promote the switch through events and interactions, while the TCO-based policy group rather has a more organic transition from combustion to hybrid and then hybrid to electric.

Full electric policy vs TCO based policy

Organisations tend to cover charging costs

Out of all organisations we interviewed, 100% facilitate charging infrastructure and costs for their employees. This covers both charging at home and public charging, as respondents appear committed to providing their employees with comfort against range anxiety.

As far as charge station installation reimbursement is concerned, we see again a clear difference between respondents with a full electric policy and those working with a TCO-based budget. Contrary to what could have been expected, the early adopters are less generous, considering these costs as part of the regular lease budget instead of reimbursing it on top of this budget.

Another noticeable trend is the emergence of new business models under which the charging stations are leased rather than purchased, sparing both organisations and employees a headache as the latter leave and join a new company.

Multi-modal mobility is on a roll

The past few years have seen the Belgian government actively promoting the use of alternative means of transportation, an approach that culminated in 2018 with the introduction of the Federal Mobility Budget. The objective? Convincing employees to let go of their company or opt for a smaller model in exchange for a budget that covers the likes of bike benefits, public transport reimbursement, and even tax-exempt reimbursement of mortgage or house rate payments under certain conditions.

Mortgage / rental reimbursement appears to be the most attractive measure from the Federal Mobility Budget, accounting for up to 70% of the total mobility budget being allocated by organisations. This hardly comes as a surprise, as it provides the employee with a significant amount of his budget on a monthly basis.

Risks and legal uncertainties

The greenification of the Belgian company car fleet is reason enough to rejoice, yet there are also several concerning angles to approach the results of our survey.

The first such concern is the risk faced by our group of “slow movers”, as their tardiness in implementing a full-electric policy might cause them to overlook the broader spectrum of multi-modal mobility.

Meanwhile, as they ride the wave of electrification, few organisations seem to have realised the significant cost increases they will inevitably face as of 2027. Whilst deductibility rate reductions are still a few years from now, our projections show that, after 2027, the total cost will continue to rise as corporate tax deductions go down. This is not a good look for companies with large fleets, and further accentuates the need for broader mobility strategies.

Speaking of these strategies, we cannot stress enough the problems posed by some governmental decisions. For starters, the Ruling Commission’s position on charging cost reimbursement is increasingly challenged by organisations who see in this rule something that’s just too difficult to put in place. Whilst the Commission insists that the price of the electricity reimbursed should be the actual cost employees pay to their provider, a large number of respondents have grown accustomed to the – deemed illegal – payment based on average electricity prices published by the electricity market authority CREG.

Meanwhile, not everyone is convinced of the suitability of mortgage and rental reimbursement: some argue that it can create a disparity within the workforce as the measure is strictly aimed at employees entitled to a company car who can also work from home. This measure is administratively complex, and surrounded by legal uncertainty.

Overall, we could say that in their attempt to set up an attractive transition measure, the Belgian government may have lost sight of the fact that the Federal Mobility Budget is just a transition measure. What organisations need to know, now more than ever, is what the “end game” should be in terms of promoting multi-modal mobility.

Download the full

PwC Employer mobility policies in Belgium survey

Contact us

Contact us