Electronic Compliance Radar (eCR)

A technology powered approach to help businesses keep track of current and future e-invoicing & e-reporting obligations.

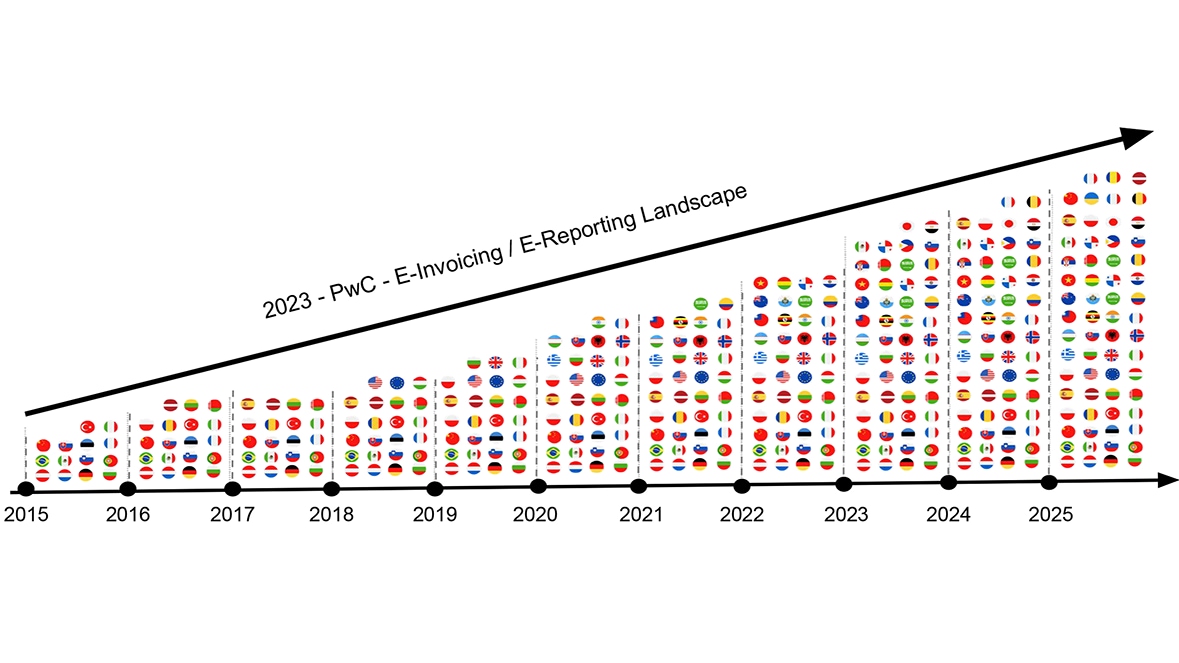

Global e-invoicing and e-reporting rules are changing at lightning speed

Multiple global and local trends are impacting the current ITX landscape and are challenging businesses to adapt existing ITX procedures and solutions.

Indeed, globally we are seeing a strong push towards electronic compliance obligations. These obligations imposed by tax authorities around the globe have more than tripled over a very short period of time.

Yet, the pace of change keeps accelerating with new mandatory electronic invoicing and electronic reporting obligations on the horizon in many countries, including some of the largest EU economies.

Businesses wish to evaluate how they will monitor their current & future obligations as well as how they respond and update their various systems and processes in a timely manner to ensure these remain legally compliant.

Explore our software

One month free trial

Get back in control with PwC’s Electronic Compliance Radar

Electronic Compliance Radar - FAQs

- What obligations are captured/analysed by the Electronic Compliance Radar?

- What are the benefits for tax, finance and IT professionals when using the PwC Electronic Compliance Radar?

- What data should be shared in order to enable PwC to create your personalised Electronic Compliance Radar?

- Which levels of support/subscription packages are available?

What obligations are captured/analysed by the Electronic Compliance Radar?

- Mandatory e-invoicing obligations: Requirements under which taxpayers are obliged to exchange invoices/transactional data electronically, using a pre-defined format and/or requiring the invoices to be exchanged via a (government-run) platform. The platform will approve the invoice before the next business processing step can take place.

- (Close to) real-time obligations: Requirements under which incoming and/or outgoing transactional data must be reported to the tax authorities in a (near) real-time frame, usually within a few working days, in a pre-defined format. The taxpayer’s data is sent to the tax authorities and does not necessarily return any approval messages back to the platform. There are no dependencies in the underlying business process (no need to receive approval/rejection messages before the next business processing step can take place).

- (On request) e-audit obligations: Requirements whereby a taxable person should be able to extract and present accounting data in a pre-defined format upon request of the tax authorities (e.g. SAF-T reporting, and other data-export functionalities for audit purposes).

What are the benefits for tax, finance and IT professionals when using the PwC Electronic Compliance Radar?

- Identify impact on your global business and IT systems.

- Determine action plan and allocate resources in a timely way to deal with unprecedented changes.

- Update various systems and processes to ensure regulatory compliance and avoid penalties.

- Obtain insights from the leading global advisor on e-invoicing and e-reporting.

- And many more...

What data should be shared in order to enable PwC to create your personalised Electronic Compliance Radar?

- Countries where you do business;

- Customer channels (B2B, B2C or B2G);

- Information on your local establishments with regard to tax registrations, and;

- Revenue (the relevant revenue per customer segment).

Which levels of support/subscription packages are available?

You can benefit from Electronic Compliance Radar either via a one-off assessment or obtain direct access to the solution via one of the subscription packages (Basic (i.e. Europe only), Standard, Premium or Custom). The views made available will depend on the support/subscription level chosen.

Contact us