What is Amount B?

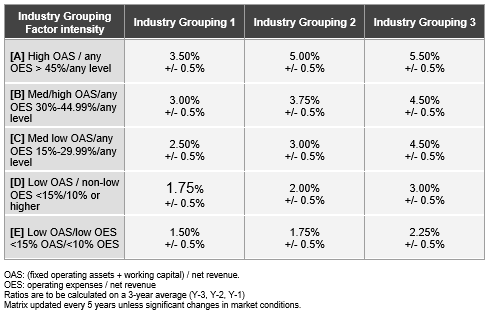

On 19 February 2024, the OECD published a report which aims to simplify and streamline the application of the arm's length principle to in-country baseline marketing and distribution activities (the Report) (also known as Amount B under Pillar One) by establishing a fixed Return on Sales (RoS), ranging from 1.5% - 5.5% (+/- 0.5%).

Amount B is meant to apply to virtually all industries selling (tangible or digital) goods in a wholesale context, and does not foresee any revenue thresholds for its application.

When does Amount B come into effect?

The Amount B guidance is incorporated in the OECD Transfer Pricing Guidelines (TPG) and can be applied for in-scope transactions for fiscal years commencing on or after 1 January 2025. Although it’s soft law, these guidelines have direct effect in many countries’ local law (and tax treaties), meaning that no local legislative process is required prior to implementation. Amount B could also be used as a resolution tool in MAP cases under certain conditions.

Therefore, it’s important to understand and evaluate the (potential) impact of Amount B on your organisation’s value chain.

How does Amount B work?

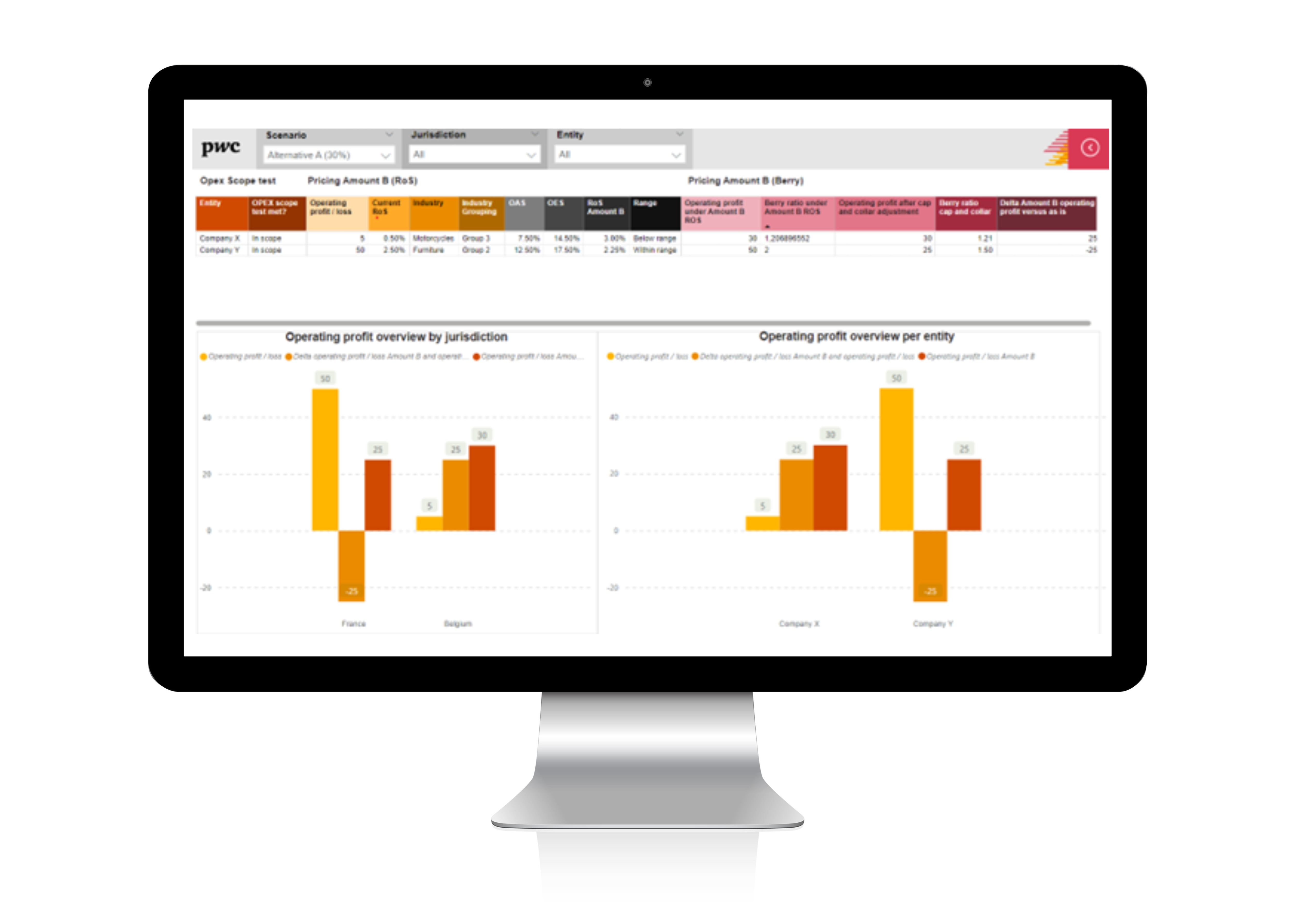

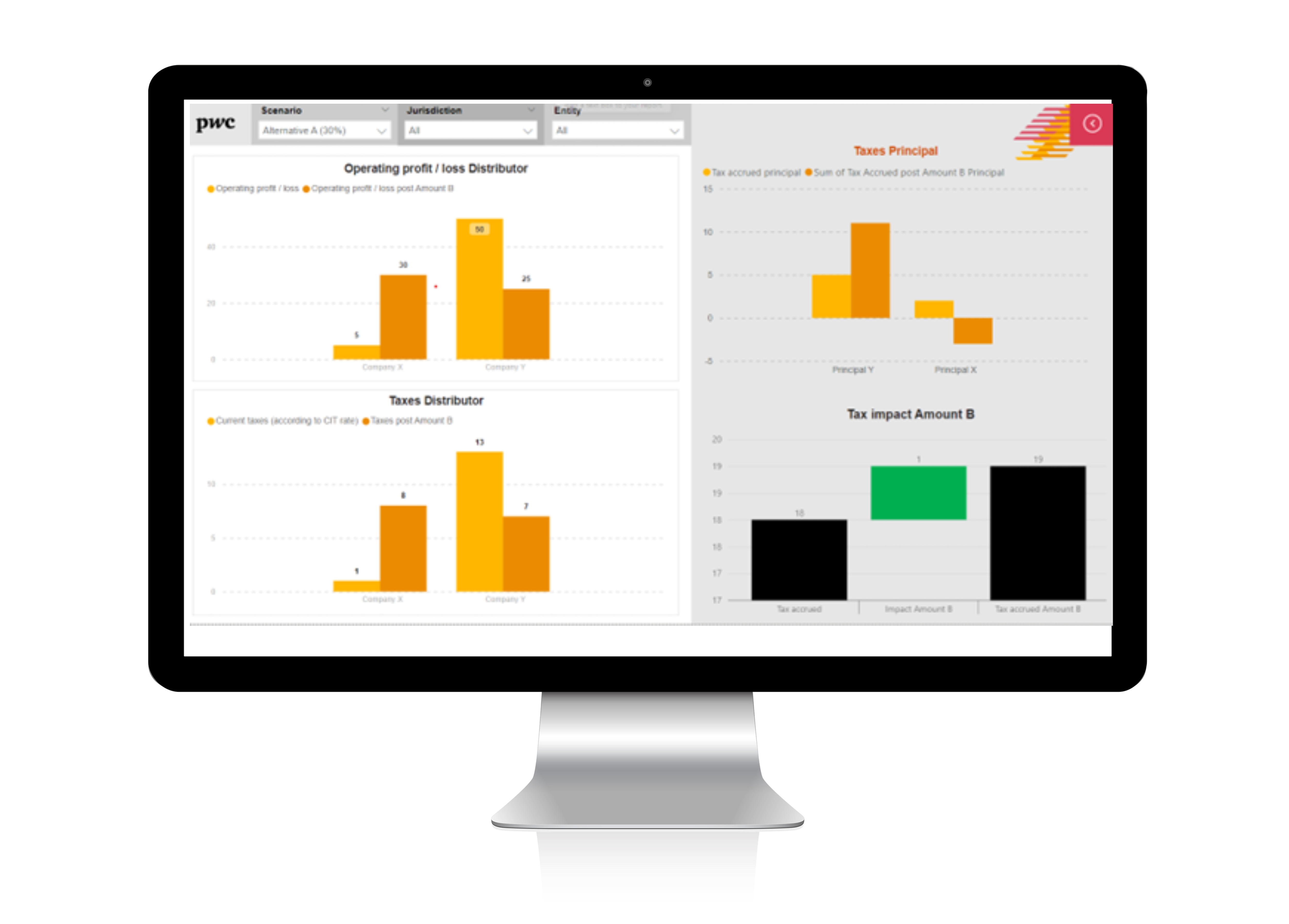

Amount B Impact Assessment Tool

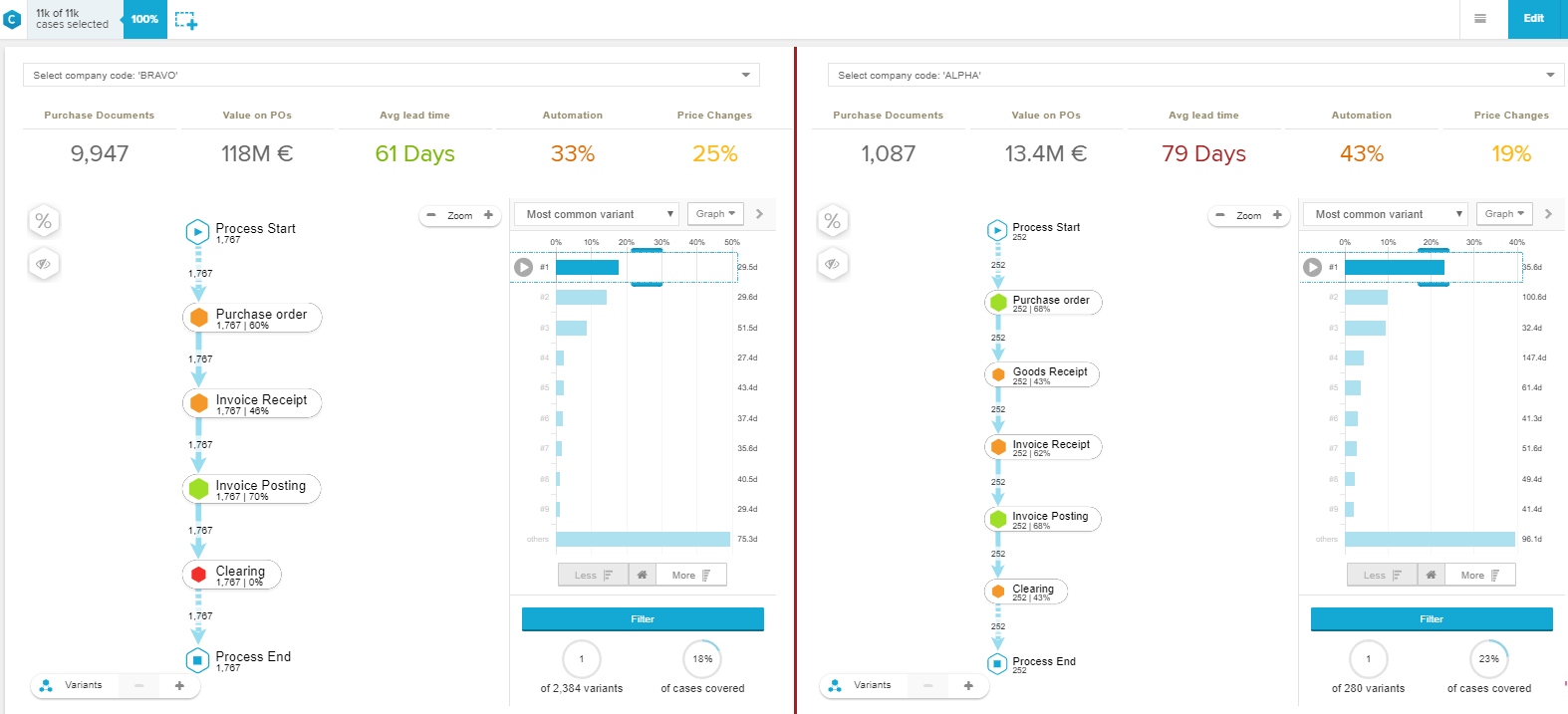

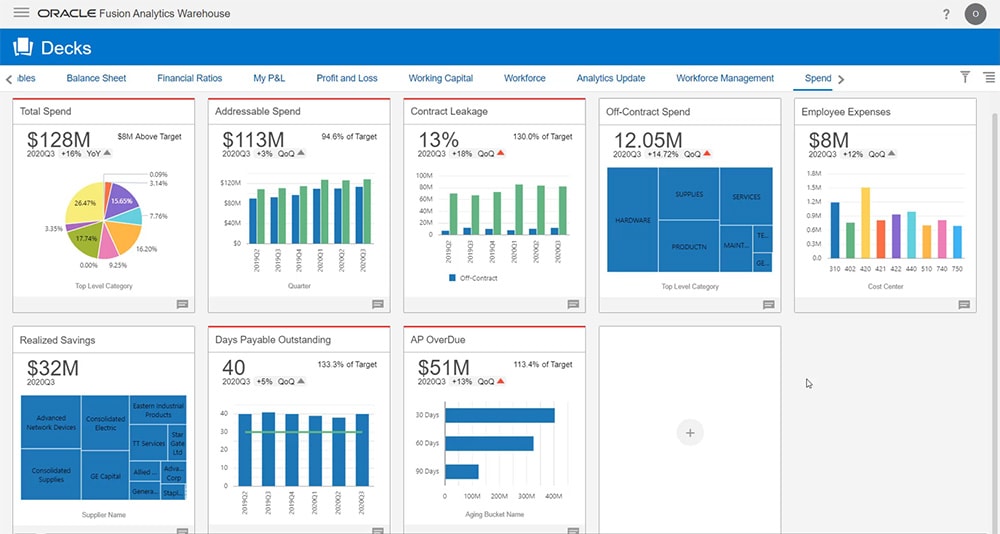

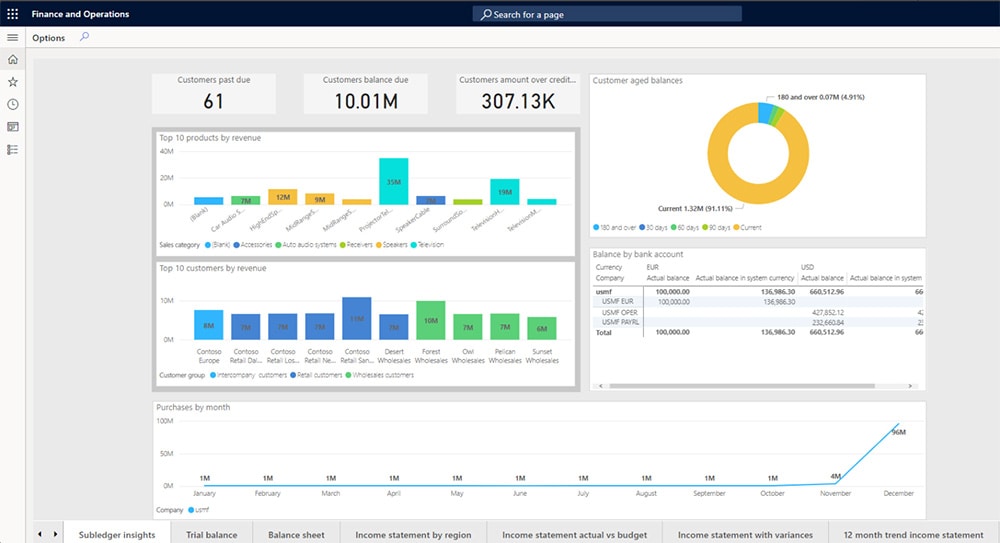

The Amount B Impact Assessment Tool can help you to assess the impact of Amount B on your tax model. It is an interactive tool that quantifies and visualises the anticipated financial impact of the introduction of Amount B from both a local and central perspective. Please see below for more details.

How can PwC assist you in the road towards Amount B readiness?

PwC professionals are happy to help determine if and how Amount B implementation would impact your organisation and tax model, as well as assist with the financial data (gathering) to be able to assess the impact thereof. Below you can find an impression of our Amount B tooling;

- Qualitative analysis

- Quantitative analysis

- Documentation

- Tax certainty

- Operational readiness

- Interaction with other tax domains

Qualitative analysis

Consider whether your activities fall within the scope of Amount B. If not, could there still be any indirect impact on entities performing other (out-of-scope) activities?

Quantitative analysis

Determine your RoS% per in-scope activity; determine and test various financial ratios. This is the starting point to assess the impact of Amount B on an entity, country and/or group level.

Documentation

Review documentation for in-scope activities to be able to reflect Amount B (e.g., intercompany agreements, TP documentation (specifically, local files), APAs, et al).

Tax certainty

Review current, ongoing and future unilateral, bilateral or multilateral agreement proceedings with tax administrations to reflect Amount B where needed.

Operational readiness

Assess whether your current processes enable you to obtain the necessary data considering segmentation, ratio testing, etc.

Interaction with other tax domains

Assess whether the implementation of Amount B on your structure would lead to spill-over impact in other tax domains such as customs and other types of indirect tax.

Contact us