What is a Tax Control Framework?

Whether it is because of ESG, internal or external audit requests, sound risk management and so on, the pressure on having a robust Tax Control Framework (“TCF”) is rising rapidly. The implementation of a TCF can help companies to identify and manage tax risks, strengthen tax governance and enhance tax transparency for internal and external stakeholders.

A Tax Control Framework (TCF) is part of the internal control framework that is designed to help organisations take control over taxes, gain valuable data insights and provide assurance to stakeholders via process design, implementation of tax controls, automation and documentation.

Why would my company need a Tax Control Framework?

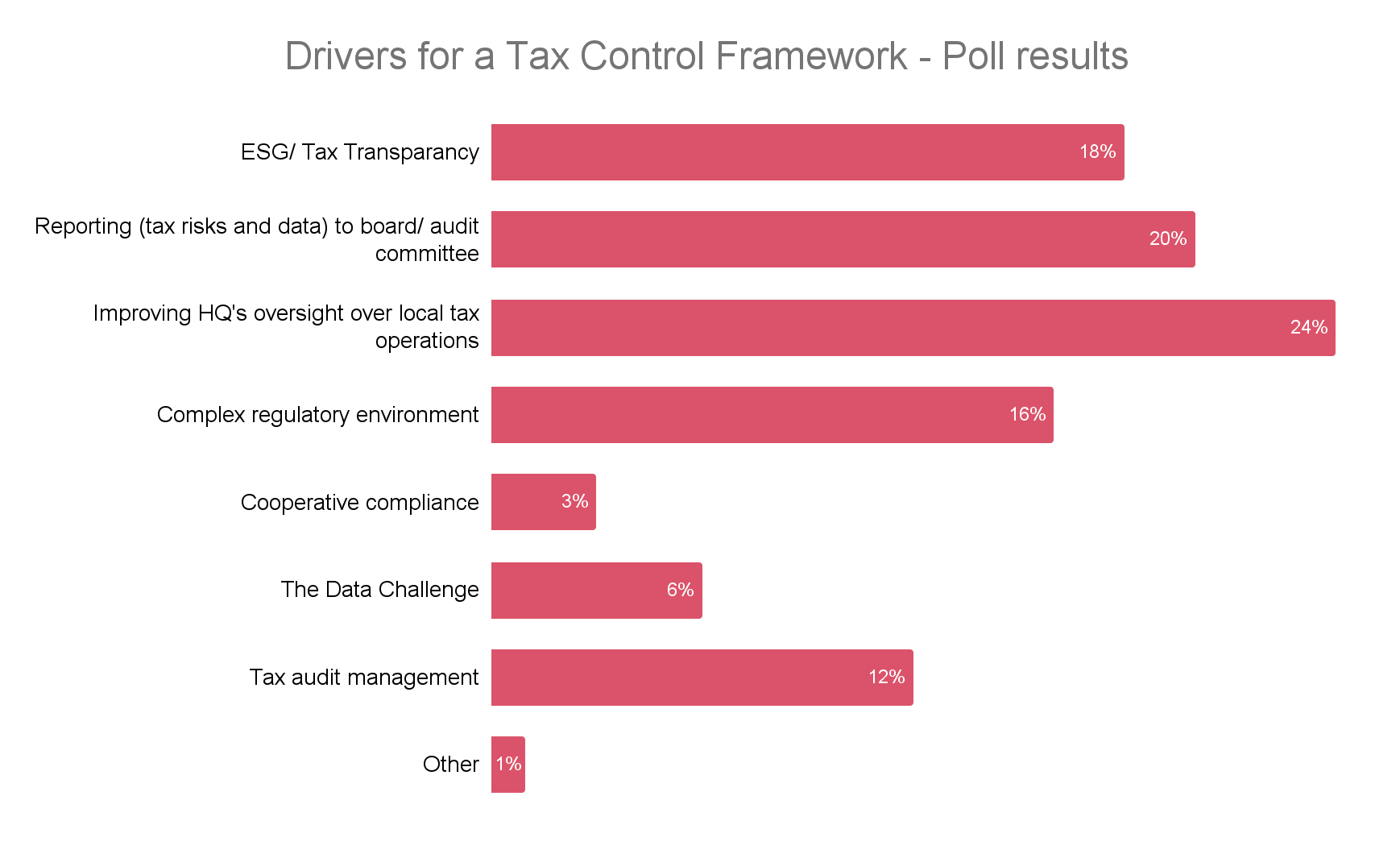

According to a poll conducted by PwC Belgium, there are several reasons why organisations are designing and implementing a Tax Control Framework. The graph below indicated the most common drivers, but there may be others as well relevant for your business.

How can PwC assist you with the design of a robust TCF?

Be in control… and evidence it!

Aligned with the 6 building blocks of a robust and effective Tax Control Framework of the OECD guidance and accepted by tax authorities around the world, PwC helps organisations with the design and implementation of a Tax Control Framework.

Our pragmatic and modular approach focuses on maximum value creation in the short and long term period.

- Tax strategy & Policy

- Roles and responsibilities (RACI matrices)

- Processes

- Risk assessment

- Design, implementation & testing of controls

Tax strategy & Policy

A well-defined tax strategy is fundamental to effective tax management and compliance within an organisation. It involves outlining the principles and guidelines that steer tax-related decisions and actions (e.g. risk attitude, relations with authorities and other stakeholders, tax planning risk attitude,...). The tax strategy should be rolled-out and communicated throughout the organisation (also outside of the Tax department).

What we see within Leading Practices

- Tax Strategy annually approved by Board

- Design external and internal communication (enforcement) plan

- Voluntary publication, completed with Total Tax Contribution

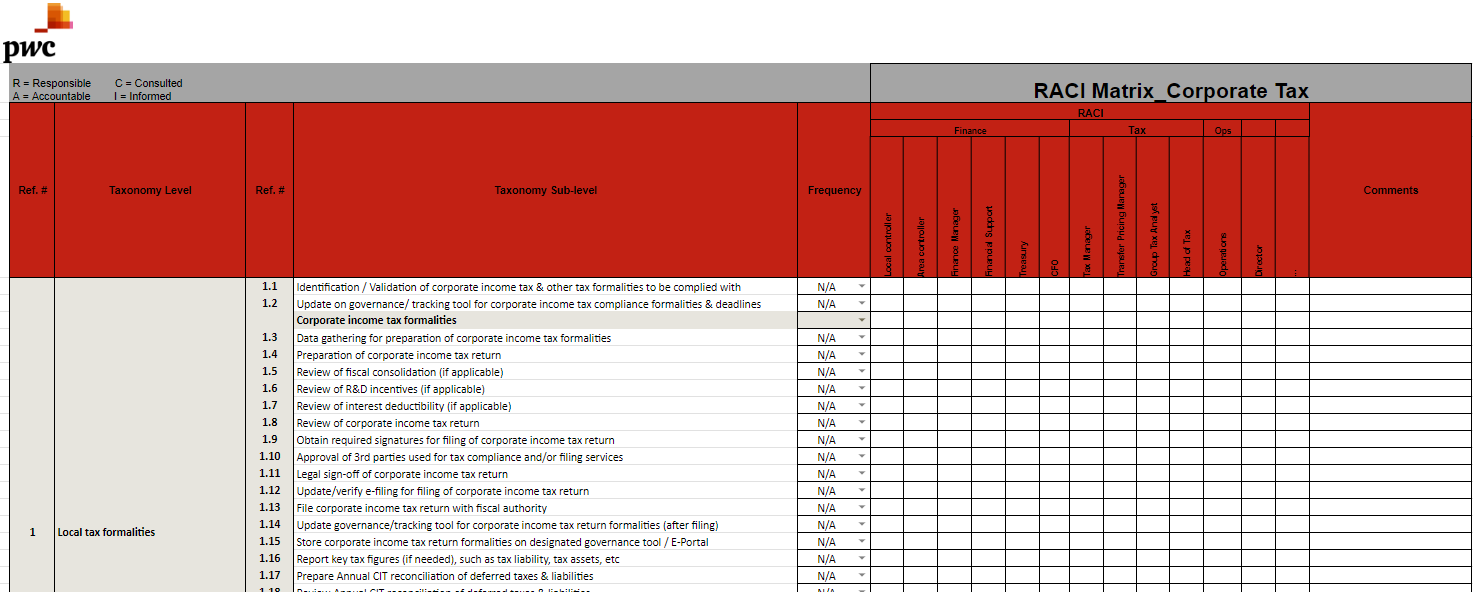

Roles and responsibilities (RACI matrices)

Establishing clear and approved roles and responsibilities between Tax and other departments (e.g. Finance, Operations, HR,...) ensure awareness and enforcement throughout the business that guide tax-related activities within your organisation, ensuring consistency and compliance with applicable tax laws and regulations.

What we see within Leading Practices

- Formalised, documented and approved RACI matrices

- Workflows to track deadlines, status and sign-offs

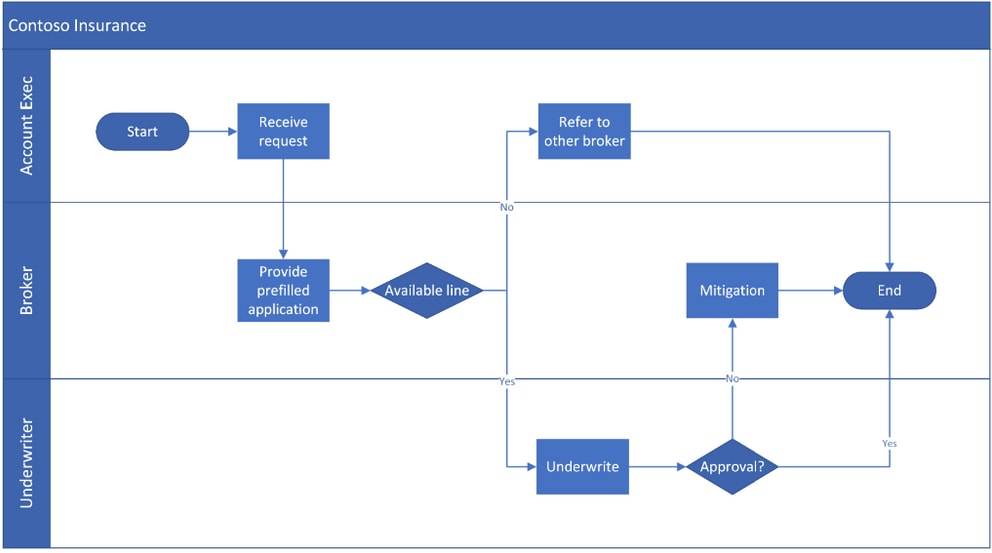

Processes

Clear guidelines on processes and procedures ensure that all tax-related activities within your organisation are in line with tax laws and regulations and - where needed - streamlined over your different business units, territories or departments.

What we see within Leading Practices

- Documented procedures and guidelines (e.g. tax manuals) rolled out to tax and finance people who have tax responsibilities

- Governance tools to monitor status of reporting obligations, track key financial figures, tax audits, etc.

- Centralisation of compliance work in shared service centre / single or preferred service providers

- Implementation of tax modules within ERP system (eg G2S2T, VAT & real time reporting, operational TP, tax accounting, Pillar II push, etc

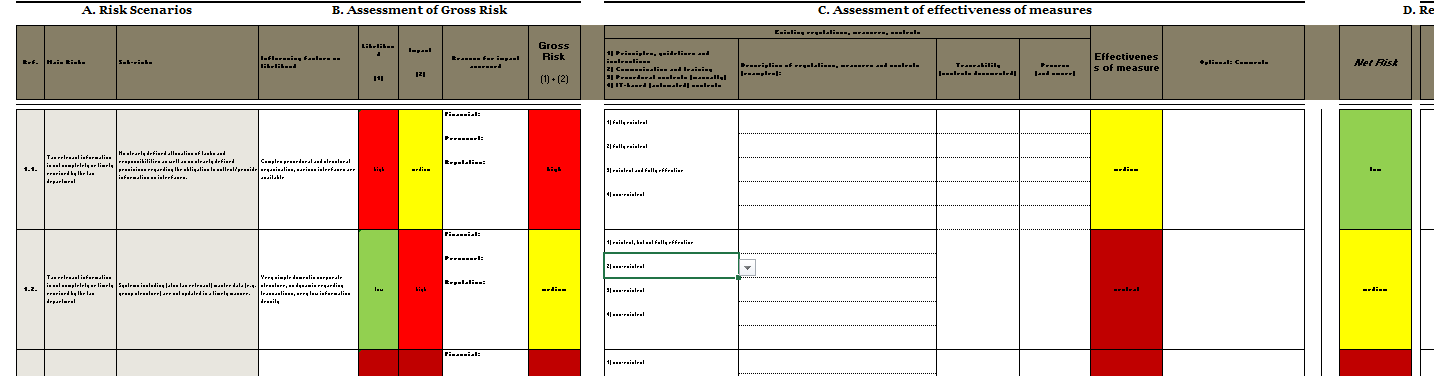

Risk assessment

Identifying and assessing tax risks specific to your industry, operations, and jurisdictions is the first step. Understanding potential risks helps tailor the framework to mitigate those risks effectively.

What we see within Leading Practices

- Tax risk profile matrix with inherent tax risk and mitigating measurements

- Upward reporting to Tax HQ and the Board by local operations of risks throughout the year

- Board discussion on tax risks

Design, implementation & testing of controls

An effective control environment is vital for ensuring that tax-related activities align with the organisation's objectives and regulatory requirements. It is important to identify and also validate the existence of controls suitable for your organisation’s environment to increase control and oversight of (foreign) taxes and tax processes.

What we see within Leading Practices

- Implementation of ‘Minimum Control’ Environment

- Automated VAT controls

- Manual managerial controls for CIT but recent push to automation

- Testing plans and implementation of continuous monitoring tools

Want to know more?

We are here to support you in developing and implementing a tailored Tax Control Framework that aligns with your organisation's needs and objectives.

Our core team comprises dedicated and multidisciplinary people with many years of experience in Tax Control Framework projects for both multinationals and SME’s, and always tailored to the client’s business environment. Feel free to download our flyer and reach out to us for further assistance in optimising your tax management processes.

Download our

Tax Control Framework flyer

Contact us

Annelies Butaye