Chapter 6: The Fundraising process: Preparation phase - Startup valuation

Listen to the audio version here:

Valuation is often a hot topic during fundraising, because it’s a key factor in negotiating how much ownership to give investors in your company. Therefore, it’s important to understand how to value your company.

In this blog post, we describe six different methods for valuing your startup.

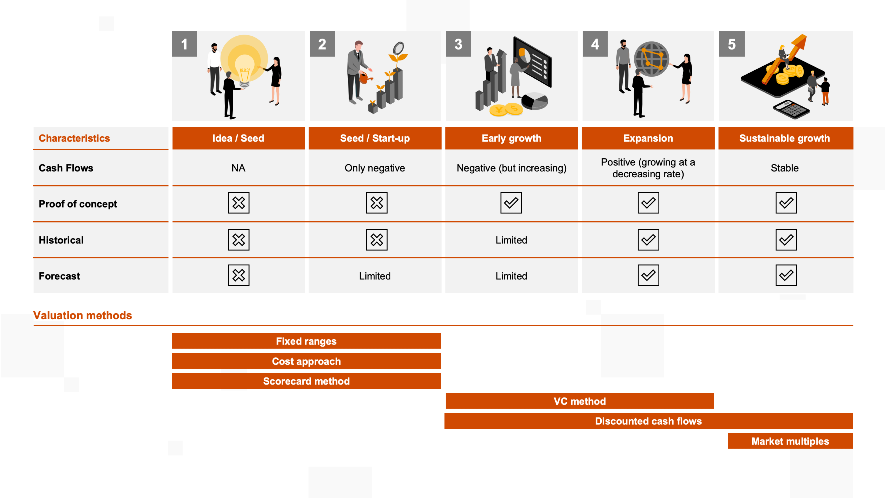

As shown below (figure 1), there are several valuation methods that can be used depending on the growth stage of your company.

Figure 1: Valuation methods and growth stage

These valuation methods have different advantages and disadvantages, which are explained in the following section:

Fixed ranges

In this approach there is a predefined fixed valuation range, usually set by the investor. Investors propose a ‘take it or leave it’ investment offer, which is based on a fixed range of capital offered in exchange for a share of ownership. These valuation ranges are based mainly on the investors’ past experiences and feelings, as well as their investment strategy. For example, some investors (typically accelerators and incubators) offer a fixed investment for a fixed share of equity. This implies that the investor is able to offer the same investment terms to all startups.

Pros

- It is easy to apply and time-efficient

- There are no surprises for startups as they know what to expect after receiving the term sheets

Cons

- There is no room for negotiation, and is considered as a ‘yes/no’ investment criteria rather than a valuation method

Cost approach

This approach is based on the costs and expenses incurred by the company since inception. All these costs are taken into account to determine the value of the company. The assumption is that the company is only as valuable as all the costs associated with launching and developing its product. For example, if the sum of costs and expenses in your company is Є500,000, then with the cost approach your startup will be worth Є500,000.

Pros

- Relatively easy to apply and time-efficient

- Reflects the idea that ‘a smart investor wouldn't pay more than it would cost to duplicate’

- Based on verifiable past expense records, hence does not lead to difficult negotiations

Cons

- Fails to capture the future potential of the company

- Doesn’t capture intangible assets created (e.g. brand value, reputation, etc.)

- Implicitly assumes that every euro and hour spent was efficiently used

Scorecard method

In this approach, investors first determine the median pre-money valuation (i.e., the valuation of a company before receiving the investment) of companies that are comparable to yours (i.e., same growth stage, location, industry, etc.). They then compare your company based on their perception of similar transactions, taking into account key characteristics such as product, team, market, etc. Investors weigh these characteristics based on their perceived importance, and then assign scores for each characteristic based on how your company performs relative to its peers. The weights and scores are multiplied for each characteristic and then summed to get an overall score. Finally, this overall score is multiplied by the median pre-money valuation of similar companies to determine your company's valuation.

Pros

- If clearly defined, easy to apply and time-efficient

- Quantitative and qualitative criteria relevant to management and entrepreneurs

- Tailor-made based on investor’s strategy and needs

- Allows for comparison between similar start-ups active in the same sector

Cons

Selected criteria not necessarily aligned with market practice

Scoring and weighting are subjective

VC method

This method is considered a forward-looking approach that depends heavily on assumptions about the company's growth prospects. Using this method investors estimate the potential exit value of your company, which is typically done by projecting the future earnings of the business over a period of time (e.g., 5-10 years). This is then used to calculate a terminal value (or exit value) based on a multiple of projected earnings (e.g., 10x, 50x, etc). The main assumption in this method is that your company will achieve a high growth rate and become profitable within a few years, leading to a successful exit (e.g., through an acquisition or IPO). The valuation is based on the expected return the investor would receive if the company is sold at the estimated exit value.

Pros

- Useful to value early stage (‘pre-revenue’) startups

- Useful to compute required rate of return

Cons

- Focuses only on revenues/earnings

- Highly dependent on exit assumptions (foregoes criteria such as team, traction, risks, etc.)

- Requires a selection of start-ups to compute potential exit value

- Subject to long negotiations

Discounted Cash Flow (DCF)

This valuation method estimates the intrinsic value of a startup. It involves projecting future cash flows over a specified period of time (e.g., 5-10 years) and discounting them to their present value using the weighted average cost of capital (WACC) - a risk-adjusted discount rate. The DCF approach requires assumptions about sales growth, profit margins and other key financial metrics. The discount rate reflects the risk associated with the company's business activities and includes the cost of capital for investors.

Pros

- Theoretically robust method of a business valuation

- Provides an intrinsic value of a business

- Includes company’s growth assumptions

Cons

- Highly sensitive to inputs or assumptions made in the model

- Difficulty in assessing the WACC for a start-up

- Derives most of the value from a future time period (5-15 years or more)

- Most appropriate for more mature businesses with predictable growth

Market multiples

This approach compares your financial metrics to those of similar publicly listed companies in the same industry or sector. The most commonly used multiples are the price-to-earnings ratio (P/E ratio) and the enterprise value-to-revenue (EV/Revenue ) ratio. To use the P/E ratio, the startup's earnings per share (EPS) is divided by the current market price per share. This ratio is then compared to the P/E ratios of similar publicly listed companies to determine the valuation of the startup. When using the EV/Revenue ratio, the startup's enterprise value (market capitalisation plus debt minus cash) is divided by its annual revenue. This ratio is then compared to the EV/Revenue ratios of similar publicly listed companies to determine the valuation of your startup. The market multiples approach assumes that the publicly listed companies used for comparison are good benchmarks for valuing the startup and that the startup's growth potential is comparable to those companies.

Pros

- Easy to apply and time-efficient

- Based on public information

- Realistic valuation

- Widely accepted by the investment community

Cons

- Misinterpretation possible due to different accounting policies of comparable companies

- Fails to include the company’s growth

- Difficult to find proper comparable companies when valuing innovative companies / startups

PwC Pro Tip

- All of these valuation methods have their pros and cons, so it’s helpful to use more than one when valuing your company. This way you can get a good overview of what your company is worth.

- Having access to good quality company databases can be very helpful in finding comparable companies.

Valuing your company is an important part of the fundraising process, however it should be noted that valuation methods are only indicative tools for negotiation. These tools should thus be used as guides to help you negotiate better investment terms for your company.

In the next blog post, we will look at another phase of the fundraising process, which is the reach out phase. Stay tuned for a deep dive into best practices for investor reach out.

For more information on how PwC can support you in your fundraising, and how we support startups and scaleups in general visit our website.

Download the full PwC's fundraising whitepepaper here

Preparation phase

Preparing a financial model