Now, as Health Industry (HI) enthusiasts, let’s delve into the feedback provided by CEOs from companies in the Health Industry (HI) sector, which comprises both healthcare services (HCS) and pharmaceuticals and life sciences (PLS). Our aim is to get a comprehensive understanding of the key factors shaping the Health Industry, and to inspire forward-thinking approaches that will lead to resilient, innovative, and sustainable outcomes.

In summary, we see in this survey a nuanced set of answers in terms of trends, challenges, and opportunities that offer a glimpse into the trajectory of evolution that CEOs in the Health Industry believe their sector will follow in the coming years.

Key takeaways

Consider the long-term viability of your business model

Globally, 97% of HI CEOs report they’ve taken some steps to reinvent their business in the last five years. But translating actions to results is challenging. Despite their efforts, 43% of HI CEOs say they’re not confident their business will be economically viable in a decade if they stay on their current path. A potential way out is via merger & acquisitions, as half of the HI CEOs plan to conduct at least one acquisition in the next three years, indicating an upswing in M&A activity.

Understand the impact of regulation

In a fast-moving environment, Health Industry providers have a clear need to reinvent themselves. But they face structural barriers to change. Among CEOs of Health Industry providers, 72% say that the regulatory environment inhibits their company from changing how it creates, delivers, and captures value (compared with 64% of global CEOs). Regulatory issues are an understandable fact of life in the Health Industry, but CEOs need to have transparency about the current state of regulation—and the likely future direction of travel.

Move fast but responsibly on generative AI

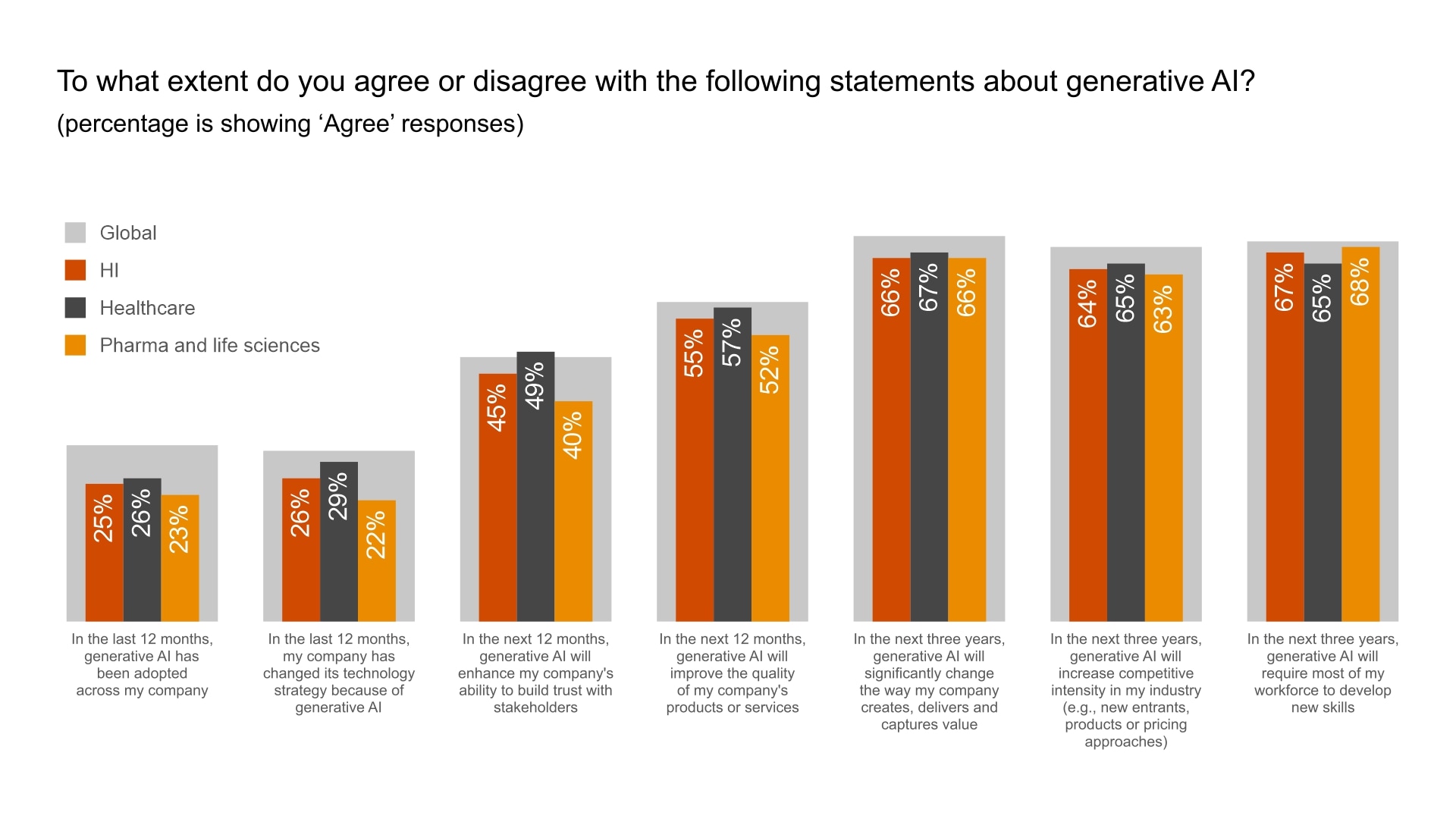

In the next year, a significant share of HI CEOs expect generative AI to increase efficiency in employees’ time at work (65%) and improve the quality of their company’s products or services (57%), among other benefits. But CEOs are also concerned that generative AI will increase cybersecurity risk and bias and pose other challenges. As you explore generative AI’s bright potential, don’t forget to dedicate serious and consistent attention to its potential pitfalls.

Go beyond decarbonisation for sustainability

HI CEOs say their company is making the most progress on improving energy efficiency, including reducing energy consumption. But far fewer of these CEOs have plans for other climate actions, such as incorporating climate risk into financial planning and nature-based solutions. Look for opportunities to create nature-positive business models that don’t just mitigate risks, but also strengthen financial returns and benefit society.

Understand the power of the megatrends

Powerful, transformative forces are driving the need to reinvent. Among HI CEOs, 60% say that technological change will drive the way their company creates, delivers and captures value in the next three years. Demographic shifts will also drive business model reinvention, with 39% of HI CEOs pointing to this (compared to 27% of global CEOs). Consider how technology and climate change might interact with regulation and customer preferences to help you reimagine the future ecosystem in which you intend to operate.

Navigating optimism in a dynamic landscape

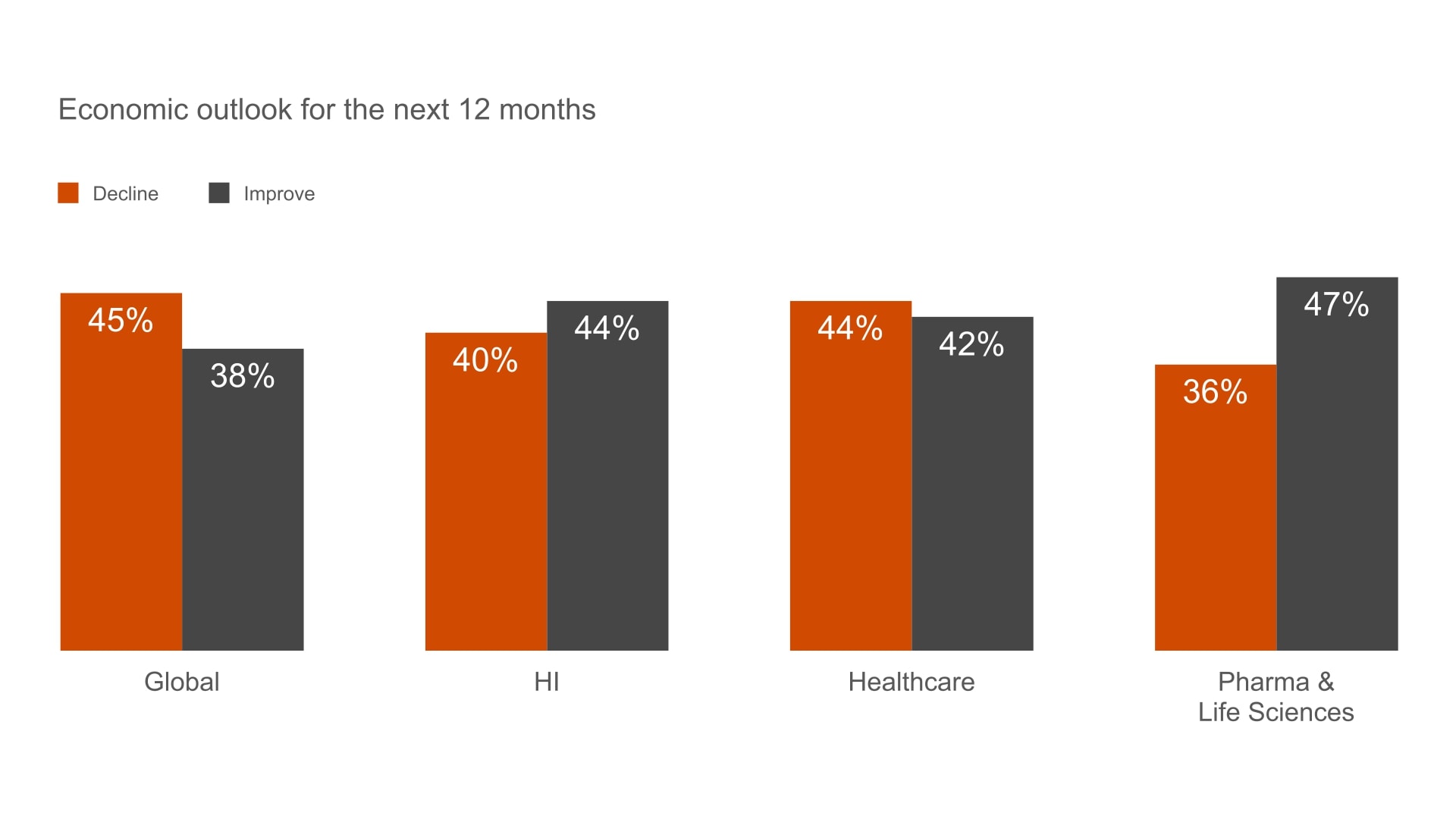

While the global survey indicates a divergence in expectations regarding growth in the global economy over the next 12 months, with 45% of survey respondents anticipating a decrease and 38% foreseeing an increase, Health Industry (HI) CEOs have a slightly more optimistic perspective, with 40% of them projecting a decrease and 44% anticipating growth. The pharma and life sciences (PLS) sector specifically stands out as a beacon of positivity, with close to half of the respondents envisioning an upswing in the next 12 months.

Although the outlook of HI CEOs on the global economy for the next 12 months is pulling in both directions, we do see that the Health Industry in general has a strong belief it will be able to improve on key growth indicators such as headcount or prices of products/services in the same time span. Health Industry stakeholders are more inclined to bolster their workforce, with almost half of the respondents likely to increase their headcount in the next year, surpassing global averages. The sector has a similar expectation regarding its pricing environment, as more than 50% of its leaders are confident in the value offered by their products and services. 58% of healthcare CEOs and 51% of pharma and life science CEOs, versus only 6% of overall HI CEOs, are considering a decrease in prices. We believe this confidence opens a strategic window for leaders to carefully reshape their pricing strategy in the following years, as only 19 % of the survey respondents indicated that the implementation of a novel pricing model impacted to a large extent the way value was created and delivered over the last 5 years.

"43% of HI CEOs say they’re not confident their business will be economically viable in a decade if they stay on their current path"

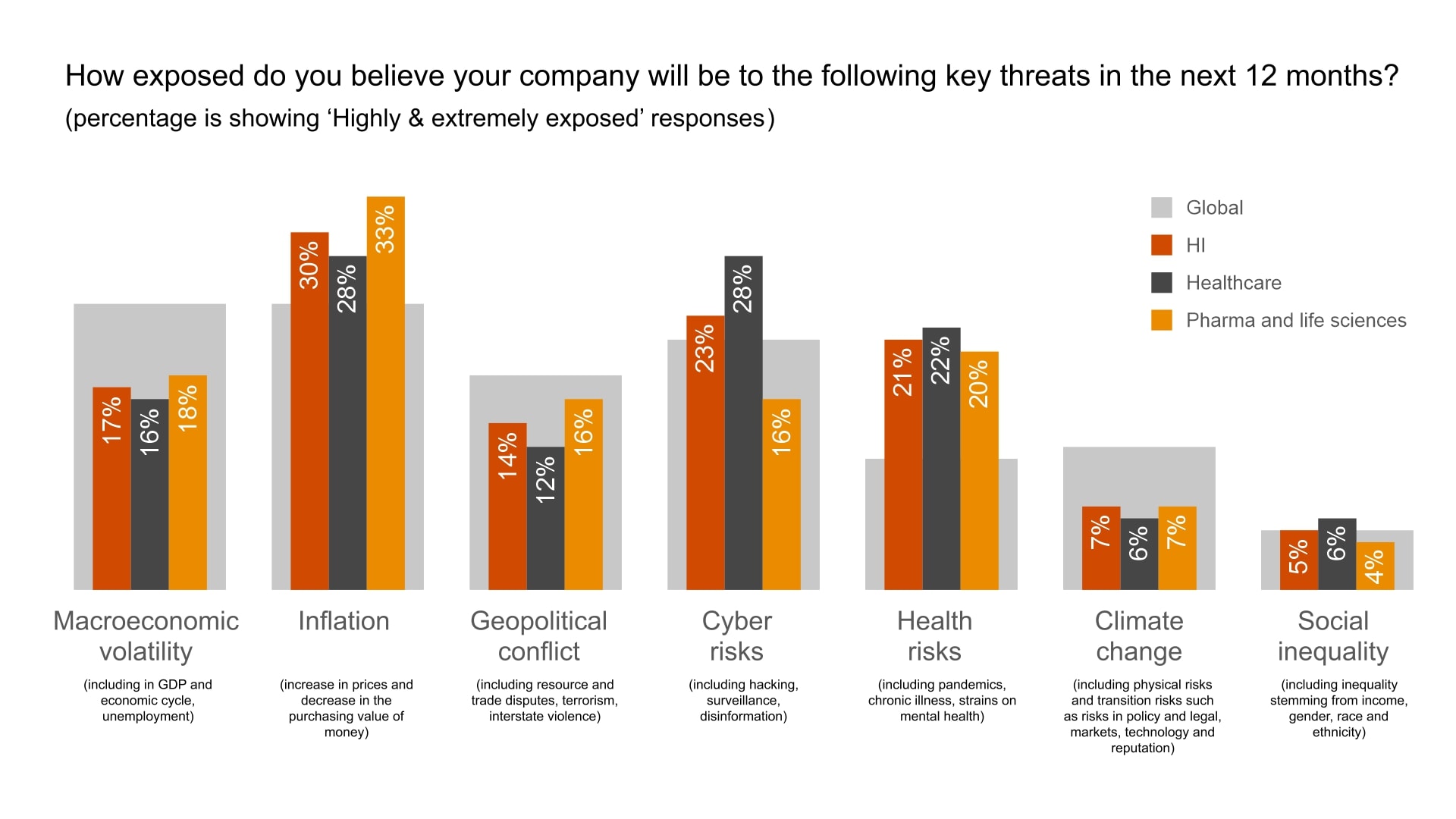

Nearly half of the respondents said they were very or extremely confident in revenue growth for the next twelve months, surpassing the global average of 37%. We even see a more optimistic view, as 60% of HI CEOs are very or extremely confident that their company will realise revenue growth over the next 3 years, compared to 49 % overall. Potentially, the slightly lower confidence among HI CEOs in terms of revenue growth for the next 12 months, compared to the next 3 years, stems from how exposed they feel in the short term to threats such as inflation (30%), cyber risks (23%) and health risks (21%). Hence, adequate risk management remains imperative. Ensuring effective risk management strategies are in place will be essential to navigate emerging megatrends, including in the realm of advanced technologies and evolving climate conditions.

Approximately 33% of HI companies have conducted a major acquisition – more than 10% of assets - in the last 3 years, with healthcare services (HCS) being more active (40%) than pharma life science (PLS) companies (26%). The fact that PLS companies have done less acquisitions can be explained by their focus on divesting non-core assets to generate cash and fund new investments into core competencies. 54% of HI CEOs expect to do at least 1 acquisition in the next 3 years, which is slightly below the overall average of 60%.

Gen AI as a catalyst for change

In general, we see a consensus among HI CEOs that GenAI will start to play a more significant role in the coming years in how businesses are transformed. Steering this transformative potential is a polarising exercise in itself, as 6 out of 10 HI CEOs look forward to a reinvention of traditional business models that will significantly change the way their companies will create, deliver, and capture value, while at the same time anticipating an increased competitive intensity as the integration of AI technologies reshapes the competitive landscape (64%).

HI CEOs are aligned with their peers in acknowledging that GenAI presents a vast potential for unprecedented opportunities, while creating at the same time challenges to overcome. In our survey, we asked the CEOs to what extent they believe generative AI will result in an increase over the next 12 months.

- 4 out of 10 HI CEOs anticipate increased revenue and profitability as a direct result of embracing AI.

- 6 out of 10 HI CEOs believe GenAI will bring efficiency gains to the workforce, especially in the PLS sector, where 73% of HI CEOs expect efficiencies in their employees’ time at work, emphasising GenAI’s role as a catalyst for reduced working time for both employees and employers within the industry.

The adoption of GenAI in the Health Industry is slower than global averages. A majority of HI CEOs indicated that within the last year, they did not adopt GenAI across their companies (64%) and/or that GenAI has not led to a shift in technological strategy (59%).

As detailed in our Global M&A Trends in Health Industries, the Health Industry is about to experience accelerated mergers and acquisitions (M&A), with GenAI playing a pivotal role here. Innovative companies harnessing GenAI capabilities are poised to attract substantial investor interest, driving value across industries by revolutionising critical areas such as drug discovery and development in the PLS sector, and by transitioning to value-based care within the healthcare services sector through digital direct-to-consumer offerings and smart health devices.

Amidst these changes, HI leaders are recognising the impact of GenAI on the workforce. Proactive engagement strategies, including upskilling initiatives and transparent communication about the role of GenAI, can empower employees to embrace the transformative potential and contribute to the successful integration of GenAI in their respective companies. 67% of HI CEOs are therefore expecting their workforce to develop new skills in the next 3 years thanks to GenAI.

Balancing financial strain against the climate clock

Like in all sectors, climate considerations are emerging as a pivotal megatrend shaping the trajectory of companies. The health industry (HI) sector is therefore at a crossroads to engage onto a course towards sustainability.

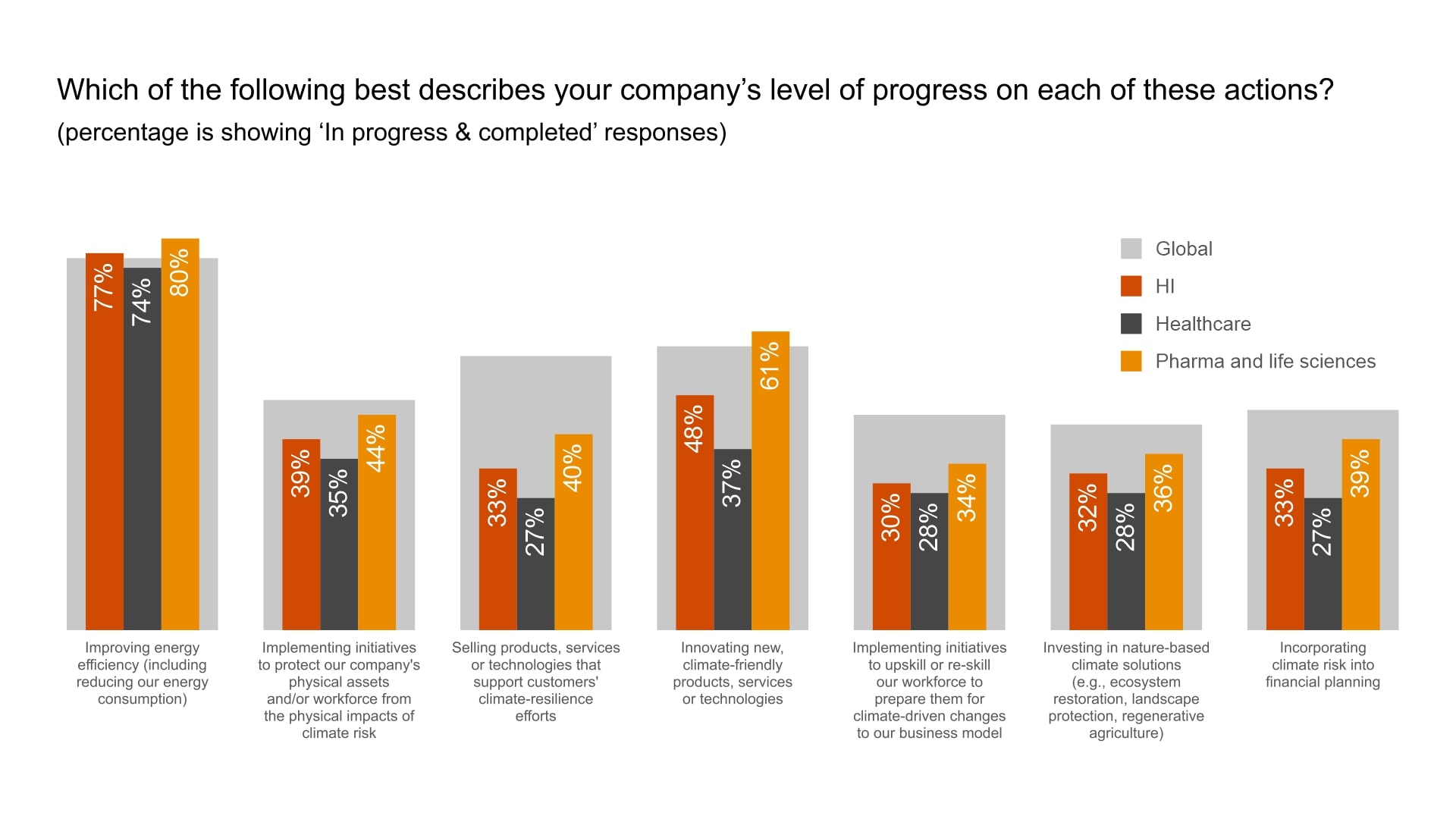

Looking at the overall response rate, we notice that HI leaders are lagging behind the average of industry leaders in terms of incorporating climate-friendly actions in their organisation. Healthcare services companies in particular are significantly behind the overall average, as only 3 out of 10 healthcare CEOs indicated they have taken or completed a climate-friendly activity. With exception of activities focused on improving their energy efficiency with a ultimate goal to reduce consumption, as we noticed that the Health Industry is at par with other industry sectors (76%) - pharma and life science (PLS) is even ahead of other industry sectors, with 80% of PLS CEOs indicating they are actively working on this. Also, in terms of innovating into new climate-friendly products, services or technologies, we see that pharma and life science (PLS) companies (61%) are ahead compared to their industry peers (58%).

The overall appetite of leaders to invest in actions to reduce energy consumption and/or to make their company more climate-resilient is higher than investing in other climate actions such as upscaling workforce, protecting assets against climate risk, or incorporating climate risk in financial planning. This trend is no surprise given the global landscape. Surprisingly, while the acknowledgment and adoption of climate-friendly practices is slower within the Health Industry, greater resilience is displayed by HI CEOs in terms of factors hindering their ability to decarbonize their business model, such as lack of management buy-in, lack of technologies, lack of demand from external stakeholders, and especially lower returns on investments. Part of this question also addressed the impact of regulatory complexity to decarbonize, and the answers collected were in line with our expectations: 3 out of 10 PLS CEOs consider it an inhibitor, while only 1 out of 10 HCS CEOs consider it a blocking factor, compared to an average of 2 out of 10 CEOs across sectors.

Examining the extent to which climate change has impacted over the last five years the way companies create, deliver, and capture value reveals a substantial gap. Only 5% of HI CEOs acknowledge that climate change has driven significant changes, sharply in contrast with the global average of 22%. The same trend is visible when we ask the same questions looking at the next 3 years, where 14% of HI CEOs acknowledge a significant impact of climate change on how they create, deliver and capture value, compared to 30% of industry leaders overall. Similarly, as with adopting climate-friendly actions, we see the healthcare services sector well behind the pharma and life science sector. This can perhaps be explained by the constraint of limited financial resources forming a substantial barrier, as 60% of HCS CEOs say inadequate cash flow and/or difficulties in raising capital are an inhibiting factor for changing the way they create, deliver and capture value, including climate-driven changes – compared to 48% of PLS CEOs.

Would you like to discuss in more detail or to exchange thoughts?

Don't hesitate to reach out!

Contact us