Read more on corporate venturing

Some background

In a previous whitepaper, AMS and PwC established that looking for innovation outside of an own company can lead to solutions driving cost reductions, new revenue streams, and increased knowledge on upcoming global trends and much more. While exploring not only the ‘why’, but also the ‘how’ to kickstart Corporate-Startup Collaborations (CSC), one of the findings was that startups indicated small- and medium-sized enterprises (SMEs) to be their favorite type of corporate to collaborate with.

A study done by the EU start-up monitor included some interesting data on the preference of startups to team up with SMEs rather than large companies:

These statistics triggered us to dive deeper into the relevance of corporate venturing for SMEs. A relevant topic, as SMEs often struggle with the liability of smallness, face resource constraints and scale limitations and have fewer technological assets to bargain with.

Through AMS’ new research, we learn that there are some fundamental differences between SMEs and large enterprises (LEs)* in the context of CSC. This summary of the said research shares the main findings and reflections on those differences.

More specifically, we will cover insights on differences related to:

the ‘why’ (motives);

the challenges and;

the ‘how’ (process) of CSC in both types of organisations.

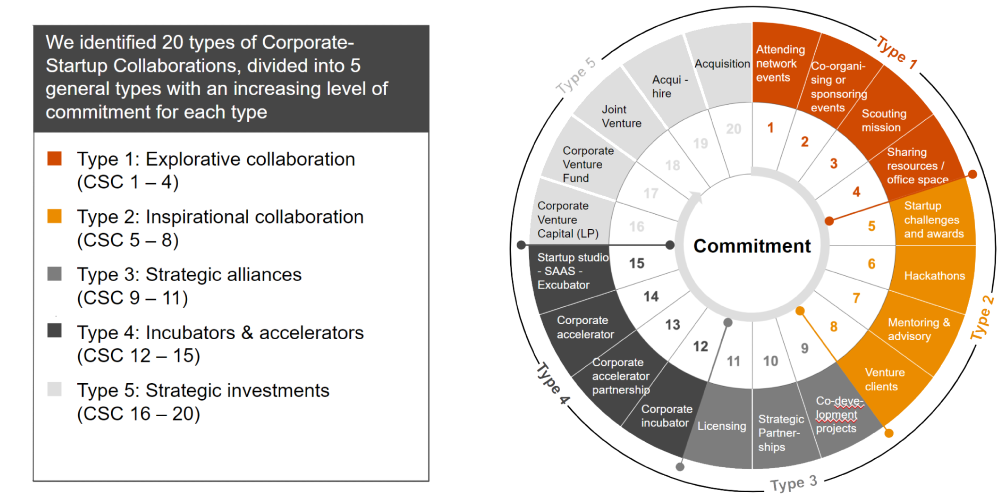

Finally, in previous research with AMS, we explored the full spectrum of corporate-startup collaborations and identified 20 different types. These are divided into 5 general types with an increasing level of commitment for each type.

In the following sections of this article, we will dive deeper into the motives, challenges and processes of CSC activities for SMEs.

Motives to collaborate

Let's take a look at the reasons why SMEs and LEs set up collaborations with startups. We see a common agreement in the importance of exploring new products and markets, but the opinions differ when looking at the next most important reason. While SMEs focus more strongly on stimulating brand awareness, large companies collaborate with startups to get access to new technologies.

The sum of percentages is larger than 100% since we could indicate more than one motive

If we ask the main motives from the other side of the table, startups prefer to partner with SMEs and LEs mostly to get customer or market access, and for product or service development. However, the third driver differs. While startups want to work with LEs because of their reputation and image transfer, spurring open innovation and working together on new ideas are the third driver for working with SMEs.

The challenges of corporate-startup collaborations

Partnering up, as in every marriage, comes with its challenges. It’s important to understand the hurdles of each potential partner to strategically choose the right one. For both SMEs and LEs collaborating with startups has its challenges, but these are not the same.

Decision-making style is less of a challenge for SMEs. We assume this comes from their smaller size and more centralized decision-making.

Cultural differences are significantly less important between SMEs and startups compared to LEs and startups, as more often SMEs are led by entrepreneurs rather than appointed CEOs.

It seems that SMEs struggle a lot more to get access to the right startups, this could relate to the lack of dedicated resources to source and meet with startups.

The sum of percentages is larger than 100% since we could indicate more than one motive

How does it work?

Finally, when it comes to connecting with startups, we see that SMEs and LEs have both common and separate paths. Networking events are by far the most popular way to connect with startups, for both SMEs and LEs. When relying on intermediaries, LEs especially benefit from the role of venture capitalists, consulting firms, incubators, universities or other intermediary organizations in connecting to startups. SMEs are less on the radar of these intermediaries in making the connection.

4 Key takeaways

The research AMS and PwC conducted has given more insights into the reasons why SMEs and LEs collaborate with startups, and the challenges both of them face. There are four key takeaways we can conclude from the research:

Both SMEs and LEs mainly realize strategic outcomes from CSC, rather than financial outcomes.

SMEs typically set up CSC to (i) explore new products and markets, (ii) stimulate brand awareness and (iii) get access to new technologies.

Although SMEs find it more challenging to get in touch with startups, they face fewer cultural challenges and experience fewer differences in decision-making styles once the connection is made.

The study shows that both SMEs and LEs can benefit from corporate-startup collaboration. As it is less realistic for SMEs to be involved in a wide spectrum of CSC activities (compared to LEs), there is a clear need to investigate corporate venturing models that better suit the characteristics of SMEs.

Podcast

Would you like to know more about this topic? Listen to our podcast series, where we discuss the difference between CSC in SMEs and LEs.