When it comes to the fight against financial crime, technological progress is a double-edged sword. On the one hand, it boosts crime prevention and detection capabilities, but on the other, it also bolsters bad actors’ arsenals. We are seeing financial criminals become increasingly sophisticated; efforts to prevent money laundering, terrorist financing, and the proliferation of weapons of mass destruction (abbreviated as ‘AML’ in this report) must rise to the challenge.

The EMEA AML Survey 2024

Although technology can be a great catalyst for progress in AML capabilities, respondents have consistently mentioned that finding qualified AML professionals that can implement new technologies is extremely difficult. This is quite a remarkable finding, since most, if not all, recent business trends involve some form of technological hype. Obviously, technology is also a key issue for our respondents, but they consider the shortage of qualified people as a major stumbling block to AML progress despite all the great opportunities technology and AI can offer; this tends to be underestimated in public discourse.

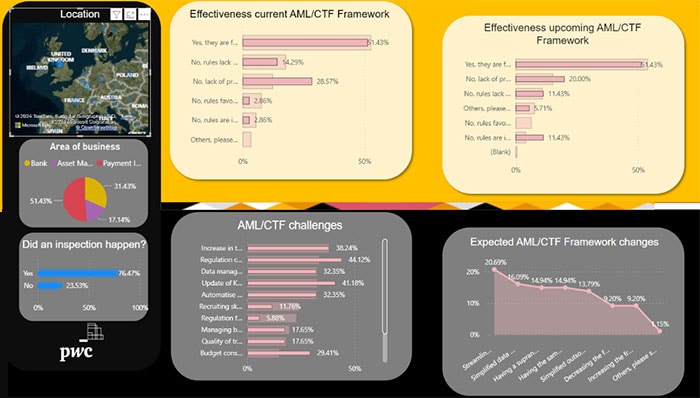

Our respondents are divided into nine major regions and three industries within the financial sector. Over half (52%) of respondents are banks, which have historically been the focus of AML regulations and are more used to being in the spotlight of AML news and events. Our Banks respondents also include 52% of all Global Systemically Important Banks (G-SIBs) and 59% of Global Systemically Important Institutions (G-SIIs). Asset managers represent 26% of respondents, while payment institutions make up a further 22%.

Belgian perspective

Key insights and distinctions from the EMEA AML Survey results. Don't miss this compelling analysis that highlights what sets Belgian financial institutions apart!

We recently unveiled findings from our extensive PwC EMEA AML Survey, which spanned 27 PwC territories and included financial institutions, asset managers, and payment institutions (collectively termed "financial institutions") from nearly 40 countries.

In the ever-evolving landscape of AML efforts, Belgian financial institutions are distinguishing themselves. Our recent analysis, comparing responses from the 17 Belgian financial institutions who participated in the survey to the broader EMEA AML Survey, reveals fascinating insights and differences.

Let's explore the key areas that set Belgian institutions apart:

I. Regulatory matters

1. Satisfaction with the regulation (existing and to be adopted)

- As for the other EMEA financial institutions, the Belgian financial institutions believe that the current AML/CFT regulations are not effective in combating money laundering. However, the proportion of Belgian financial institutions that believe the upcoming regulation will be effective is 27% higher than the proportion of financial institutions in the EMEA region that hold the same belief. In other words, Belgian financial institutions are more optimistic regarding the effectiveness of the new AML regulations.

- In addition, the proportion of Belgian financial institutions that believe the simplified data sharing rules mentioned in the article 75 of the upcoming AML Regulation, which provides for sharing information with the financial authority where financial institutions need to collect additional information in order to determine whether customers are associated with a higher level of risk of money laundering or terrorism financing, would improve their AML effectiveness is 44% higher than the proportion of the EMEA financial institutions. Indeed, only 41% of the EMEA financial institutions believe that harmonised AML/CFT rules is the key solution to improve the current AML/CFT system.

2. Belgian financial institutions challenges and investment strategy in terms of AML/CFT

- While 38% of the EMEA financial institutions (vs 29% of the Belgian financial institutions) considers the increase of the regulatory pressure as their biggest AML challenge, the Belgian financial institutions consider the additional regulation complicating their operational processes (47%) and the quality of screening tools (29%) as their biggest challenges.

II. Operational considerations

1. Staffing needs

- While, like EMEA financial institutions, Belgian financial institutions plan to increase their AML/CFT staff by 10% in the 12 coming months, they are 80% more convinced than EMEA financial institutions of the difficulties in retaining their talent due to the repetitive nature of the tasks.

2. Customer due diligence (CDD) and Know your customer’s practice (KYC)

- 35% of the Belgian financial institutions consider obtaining a source of wealth information as the most challenging aspect of the KYC process where the majority of the EMEA financial institutions (29%) considers beneficial owners’ documentation as the most challenging part of the KYC process.

- Nex to this streamlining, the storage of customer-collected information during the KYC process is an area for improvement for Belgian financial institutions compared to EMEA financial institutions. In addition, with the results of 71% of the Belgian financial institutions against 42% of the EMEA financial institutions, we can conclude that the proportion of Belgian financial institutions who want to invest in this topic is almost significantly higher.

3. Outsourcing

- Compared to EMEA financial institutions, Belgian financial institutions outsource more AML/CFT activities, namely:

AML/CFT activities |

Belgian financial institutions outsourcing results |

EMEA financial institution outsourcing results |

|---|---|---|

Transaction monitoring |

59% |

49% |

KYC onboarding |

49% |

33% |

Periodic KYC review |

47% |

33% |

Remediation |

41% |

26% |

Additionally, while Belgian financial institutions are currently more inclined to outsource major AML/CFT tasks, EMEA financial institutions are increasingly aiming to do so in the future.

III. Technology challenges

1. Interest in implementing AI for performing AML/CFT tasks

- 82% of the Belgian financial institutions are in favour of implementing AI to perform AML/CFT tasks, but are less categorical about the exact function they wish to implement AI for in the AML/CFT control system, where this figure represents 69% for BENELUX financial institutions.

- Almost 50% of Belgian financial institutions are not sufficiently aware of AI opportunities and consider this to be a constraint in applying AI tools for their AML activities, whereas .

2. Transaction monitoring system’s efficiency satisfaction

- Unlike EMEA financial institutions, Belgian financial institutions consider they should increase investment in improving their transaction monitoring system at 82%, which is almost 30% higher than the proportion of EMEA financial institutions.

- However, Belgian financial institutions would like to implement AI-based AML risk scoring in their AML functions in a significantly higher proportion than EMEA financial institutions (41% vs 28%).

Belgian perspective Conclusion

Unlocking AML Excellence: Embracing AI Innovation is key

In conclusion, the analysis of Belgian financial institutions' stance within the broader EMEA AML/CFT landscape uncovers both challenges and opportunities. Belgian financial institutions exhibit a distinct optimism towards the effectiveness of upcoming AML/CFT regulations, with a notable emphasis on regulatory changes such as simplified data sharing rules.

Belgian financial institutions are more favourable in outsourcing major AML/CFT tasks than EMEA financial institutions.

Operational challenges, particularly in staffing and operational processes, are recognized, with Belgian financial institutions highlighting the complexities of regulatory compliance and talent retention. However, these challenges present avenues for innovative solutions, e.g. implementing AI for performing the most repetitive and sometimes also time-consuming AML tasks.

Furthermore, Belgian financial institutions’ interest in implementing AI for AML/CFT tasks reflects a forward-looking mindset, albeit tempered by awareness constraints.

Implementing AI for repetitive AML tasks, KYC processes, firmwide AML risk scoring and transaction monitoring emerges as a promising solution to remediate challenges faced by Belgian financial institutions. By harnessing technological advancements, Belgian financial institutions can navigate AML/CFT regulatory complexities, enhance operational efficiency, and fortify their AML/CFT frameworks for a resilient and adaptive future.

The Robots Are Not Taking Over (Yet)

Finding skilled staff is the most important factor for effective AML compliance. Without experienced staff, carrying out day-to-day processes and updating technologies and AML methodologies is extremely difficult and may not provide the right output and quality. As a result, despite the enormous potential that revolutionary technologies like AI hold, they cannot be implemented adequately without sophisticated and experienced human staff that know how to navigate the world of AML with its many risk-based areas of professional judgement and principles.

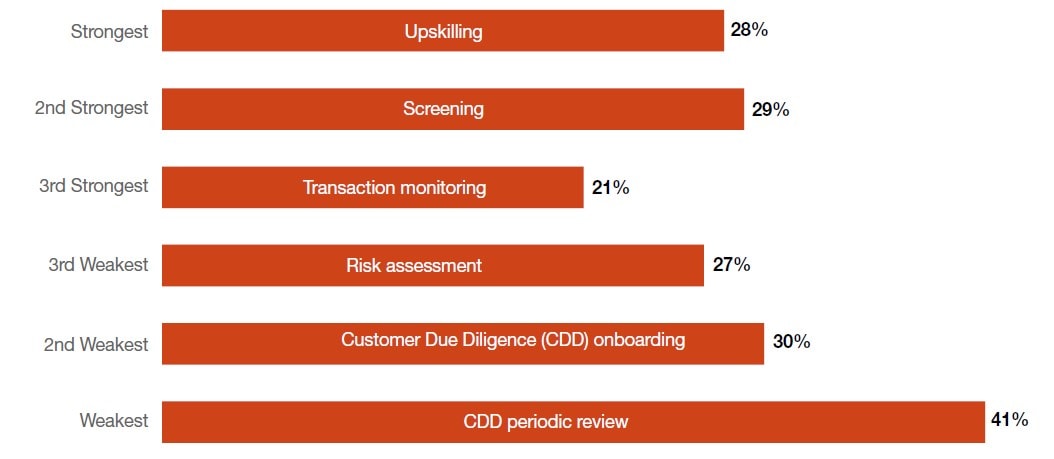

Among survey respondents, 28% indicated upskilling as the most effective AML control, while over one-third stated that the lack of skilled resources constitutes one of the main impediments to increasing the use of new technologies in their AML operations.

Most common answer when respondents were asked to rank AML controls by their level of effectiveness

Note: Respondents were asked to rank several controls from strongest to weakest. This was the most common answer for each ranking level (e.g., Training ranked as the strongest control more often than any other category, by 28% of respondents. Screening was ranked the second strongest most often, etc.)

Source: PwC Global AWM & ESG Research Centre

The Financial Sector Wants Pragmatic Regulations

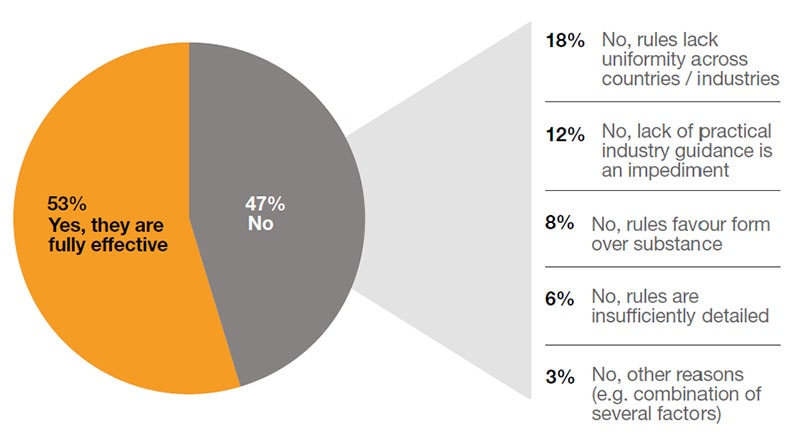

Respondents are split on regulatory effectiveness. In the EMEA region as a whole, 53% of respondents believe that current or upcoming AML regulations are helpful. Among those who do not, they tend to think the rules lack uniformity across countries and industries (18%), that there is a lack of practical industry guidance (12%), that the rules favour form over substance (8%) or that the rules are not sufficiently detailed (6%).

Among the numerous AML-related challenges faced by EMEA financial institutions, the increase in regulatory pressure came to the forefront, with over one-third of respondents (38%) citing it as the most challenging issue, while 34% also highlighted how regulations complicated operational processes.

Do you think that the current AML rules are helpful to prevent money laundering and terrorist financing, or are they too far removed from operational reality?

Note: Percentages may not add up to 100% due to rounding.

Source: PwC Global AWM & ESG Research Centre

Operations: The Human Factor Comes First

Having experienced staff continues to be one of the main determining factors of AML teams’ ability to improve and leverage technology to its full potential. Upskilling is therefore likely to be a major investment driver in the coming years. Expertise and experience are becoming even more important than before since they are more necessary than ever to leverage technology’s full potential. Increasing effectiveness via digital tools or upgrading existing tools are also key investment drivers, particularly when it comes to AI.

Over half of our respondents (51%) have seen their AML compliance costs rise by at least 10% over the last two years, with banks (62%) seeing the biggest increase among respondent categories. On average, AML costs have increased by 14%. Staff increases and investments into new digital tools have been the main cost drivers.

In addition to having skilled staff, respondents tend to view transaction monitoring and screening as the most effective AML controls.

Technology: Are New Digital Tools the Answer?

While all regions are considering implementing AI solutions to their AML operations, financial institutions in the Nordics (94%), Africa (93%) and the Middle East (93%) are the most enthusiastic. Transaction monitoring and screening are the main AML functions respondents are planning to use AI for, highlighted by 79% and 59% of respondents, respectively. However, adopting AI solutions is not all smooth sailing. Over half of respondents (55%) are concerned that the maturity of their AML processes is a constraint to AI adoption, while 52% are concerned about data-sharing with external providers.

What percentage of your AML budget do you expect you will invest in digital tools in the next 24 months?

EMEA AML Survey benchmarking tool

Thanks to the data quality achieved by the EMEA AML Survey 2024, we developed an AML benchmarking tool designed to provide organisations with unique and tailored insights on regulations, operations and technology in the EMEA AML market.

- Organisations will be able to see where they stand compared to EMEA and local industry peers.

- Dynamic dashboards will empower organisations and stakeholders to make informed decisions. We can provide you with tailored presentations for your Board or Executive Committee sessions.

- Organisations may also be benchmarked if they have not taken part in the EMEA AML Survey. Please contact us and we would be happy to organise with you a benchmarking session specific for your needs.

Download the executive summary

Download the full report

Contact us

Partner Sustainability, Risk & Compliance, PwC Belgium

Tel: +32 476 47 19 59