{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

The new government clearly expressed its intention to introduce measures to reduce the Belgian VAT Gap to the level of neighbouring countries.

The VAT Gap is the difference between the expected VAT revenues and the VAT revenues that are effectively collected. This difference is not only caused by revenue losses due to tax fraud or tax evasion, but is also a result of bankruptcies, administrative mistakes or malfunctioning tax collection, to name just a few.

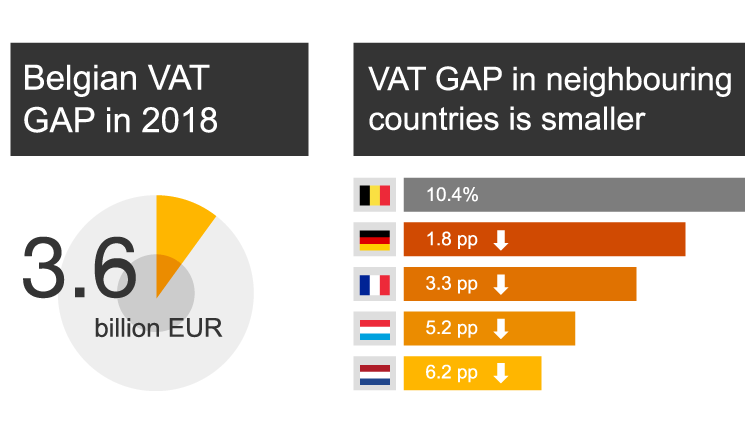

Based on a study by the European Commission (EC) published in September 2020, the estimated Belgian VAT Gap for 2018 amounted to 3.6 billion euros, or 10.4% of the expected total VAT revenue.

Compared to neighbouring countries, the Belgian VAT Gap is approximately 1.8 percentage points greater than the one in Germany and up to 6.2 percentage points greater than in the Netherlands. To put this into perspective, if the new government were to succeed in reducing the Belgian VAT Gap to the level of the Netherlands, our best-performing neighbour, extra VAT revenues of 2.1 billion euros could be realised each year.

The question is, how to achieve this goal? As with most other agreed-upon fiscal objectives, the government agreement provides no details, but inspiration can be drawn from ongoing international developments and initiatives at the EU level.

Over the last couple of years, the number of countries on a worldwide basis that have imposed requirements for digital transaction reporting (e.g. on-request e-audit requirements, real-time reporting or mandatory electronic invoicing) to combat tax fraud and to be able to perform more targeted tax audits has tripled.

The EU is also exploring possibilities on this topic. In the Action Plan For Fair and Simple Taxation, the EC announced that it will lay down a proposal by 2022 or 2023 for modernising VAT reporting obligations, which should ensure a quicker, more detailed and potentially also real-time exchange of VAT transactional data. In this context, the need to further expand electronic invoicing will also be investigated.

An important clue can be found in statements made by the new Belgian Prime Minister. In February 2020, Mr De Croo, then in his capacity as Belgian Minister of Finance, stated that he believes that the next government should mandate electronic invoicing in four or five years, and that this topic needed to be discussed during the government coalition talks that were ongoing at that time.

This statement also needs to be viewed in light of the clear push from the Belgian authorities towards electronic invoicing. Over the past couple of years, the Belgian government has been embracing electronic invoicing by making it mandatory for certain business-to-government (B2G) supplies of goods or services via the PEPPOL interoperability framework and the Mercurius platform.

Experience from Italy shows that a business-to-government e-invoicing mandate can be a stepping stone to make electronic invoicing mandatory for business-to-business (B2B) transactions as well. Closer to home, France is currently also investigating the introduction of an e-invoicing mandate by 2025 at the latest.

Want to have a discussion with our PwC specialists on how to best prepare for the upcoming changes and the impact these will have on your AP/AR processes?

Want to be kept informed on the Belgian and global developments in the area of electronic invoicing/e-reporting obligations?

Feel free to subscribe to PwC’s weekly ‘E-invoicing and e-reporting newsletter’.